Research

Settlement of non-native tokenized securities

Read our latest in-depth research on the settlement of non-native tokenized securities.

IN-DEPTH REPORT | PART TWO

Integrating Distributed Ledger Technology (DLT) into legacy Financial Market Infrastructure (FMI) is like trying to fit square pegs into round holes.

From a technological and regulatory perspective, there are many factors to account for. One need look no further than the latest joint whitepaper published by the DTCC, Euroclear, and Clearstream, the largest national/International Central Securities Depositories (ICSD), to understand the level of considerations needed to make the ecosystem work. Source: DTCC →

One particular issue is at the forefront of all discussions: settlement finality. For example, the Settlement Finality Directive (SFD), which mandates absolute certainty that a transaction is final and irrevocable, is a fundamental regulatory requirement for FMI. Source: European Commission →

However, most DLT protocols are inherently probabilistic, making it difficult and perhaps impossible to achieve true settlement finality on a DLT under the regulatory definition. Does this mean we should abandon the effort or wait for regulators to move the needle?

In a perfect digital asset world, transactions are atomic, settled in central bank money, blockchains are interoperable without the need for bridges, and consensus on ledgers is deterministic with no possibility of roll-backs or forks. But this is not the technology we have today.

Despite these technological hurdles, there is little doubt that DLT, even in its current state, can address extremely fragmented infrastructure pinned by a long chain of intermediaries.

Participants in financial markets have found current practices and technology to be burdensome on the bottom line, prompting a search for alternatives. A global post-trade survey conducted by Nasdaq estimates that a massive 78% of FMI budgets are spent on legacy technology management. Source: Nasdaq

This implies increased costs for the end user. Additionally, 64% of FMI is impacted by regulation, highlighting that digital asset infrastructure providers aren’t the only participants feeling constrained.

While regulators are experimenting with DLT regimes, in the case of the EU, there were fewer than a handful of applicants—literally four. Source: ESMA →

Meanwhile, the UK is about to launch its Digital Securities Sandbox (DSS). Despite similarities, there is hope for greater uptake of the UK program as it may attract a wider array of applicants. Source: Hogan Lovells →

This initiative is spearheaded by both the Financial Conduct Authority (FCA) and the Bank of England (BoE), which will help address possible teething issues in the full lifecycle of the trade for both securities and cash. Source: FCA →

However, it’s important to note that the DLT ecosystem is built on top of the existing FMI, with all the intermediaries invariably connected on the periphery. This means that tokenized assets are representations of securities held outside the DSS system and not natively tokenized securities that only sit on the blockchain.

Consequently, the argument can be made that the effectiveness of settling and clearing, which would showcase the advantages of native tokenization, is muted, especially in terms of service fees as DSS participants are another Jenga piece in the long structure of costs that serve little value-add within and inside the pilot.

Regardless, this process represents an opportunity. Few regulators and financial institutions have executed native tokenization. But this isn’t really the crux of the problem.

Assuming for a moment that assets within the DSS or any sandbox were indeed native, does this solve for interoperability? Do native tokenized securities solve for scale? Would this help in integration into legacy systems? What of settlement finality? And with FMI already strained of budget, would they be able to participate?

Failure to address these points, even in a perfect regulatory environment, would go against the spirit of DLT to lower barriers to entry rather than create new ones.

The question is, how can digital asset infrastructure providers demonstrate and prove, under these circumstances, that the evolution of financial markets lies in tokenization?

Required is a practical shift in what will be useful to decentralize, what will be useful to centralize, and which technology(s) could be used to propel any sandbox into a permanent regime.

In essence, every distributed ledger, despite its decentralized nature, operates with a centralized aspect in terms of issuance. While a decentralized network facilitates the use, transaction, and censorship resistance of assets, the record of these transactions depends on a single point of truth—the longest chain. The distributed ledger contributes to the robustness, security, and integrity of every network, ensuring that the definitive record remains consistent and reliable.

Similarly, for real-world assets, the gateway starts with Central Securities Depositories (CSDs), but faces challenges in its internal non-distributed ledger due to the operational burden of reconciling across multiple other organizations.

Fungibility risks, still good for progress.

Markets are highly interconnected on a global scale, with Central Securities Depositories (CSD) serving as key junctions for transactions. As the principal channels for cross-border transactions, International Central Securities Depositories (ICSD) have geared up for the surge in activity due to a shorter settlement cycle in the US who moved to T+1 last month.

Much like ledgers, CSDs have long served as the ‘golden truth’ in the financial world, providing verifiable record of securities transactions.

CSDs were initially created to immobilize physical securities certificates, thus removing the need for their physical movement during trade settlements. Advances in technology have enabled the dematerialization of securities, allowing them to exist purely as electronic records within a CSD account.

Euroclear, an ICSD, operates with a co-ownership model, in which assets are pooled, and investors are allocated a proportional share of the pool for a particular security. Source: Euroclear →

This approach eliminates the necessity to specify the owner of each security, rendering them fungible significantly speeding up the processing of securities transactions.

The Depository Trust Company (DTC) employs a comparable framework, where it acts as the nominee holding the legal title to the securities, while the end investor retains beneficial ownership. Source: DTCC →

Claiming individual shares is also possible in the US through the Direct Registration System (DRS). Both structures, nominee and direct registration each serve an important purpose for functioning markets.

There are tradeoffs. The structures change many aspects of securities in terms of ownership, control, voting rights, costs, admin, transparency, flexibility in trading and intermediary risks. Each have their pros and cons. DRS, due to its lack of fungibility, requires additional steps and therefore more time for securities to reach markets when holders want to sell.

These structures aren’t likely to change anytime soon, although it’s been well understood that native tokenization would be able to address these points to the benefit of all market participants.

Primarily, native tokenization would increase investor protection due to the absolute control over of the underlying assets.

DRS came to significant light during the GameStop saga when Reddit-led investors took matters a little further than just buying the stock and registered their names on their assets. Registering shares directly in their names led to the reduction of available supply that short sellers would be able to borrow. Source: TheStreet →

This wasn’t enough for the SEC when short interest in GameStop exceeded the number of outstanding shares and is now pushing for increased transparency on securities lending practices that would protect investor rights. Source: FT →

During the 2008 financial crisis, securities lending played a massive role in exacerbating instability within the global financial market. Source: SEC →

The significance of what assets can be borrowed through securities lending agents holds considerable weight in financial markets worldwide. The International Securities Lending Association (ISLA) reports that there are over $27 trillion in bonds and equities available as lendable assets. Source: ISLA →

Specifically, equity loans account for just 5% of available lendable assets, while bonds are utilized up to 30% of the total at any given moment. High-grade bonds, preferred as eligible collateral due to their lower market risk and volatility, are in higher demand. At the end of 2023, ISLA estimates over $2.2 trillion of assets were on-loan, the size of the gross fair market value of the US derivatives market.

In the United States, regulatory limits have been set on securities lending, which becomes particularly critical when liquidity needs to be accessed swiftly due to the narrowing window of the settlement cycle or volatility. This situation may amplify the risks tied to rehypothecation or the reuse of collateral, as was the case during the GameStop saga. Source: FT →

The fungibility of assets leads to complexity throughout the financial market infrastructure concerning the identification of the ultimate beneficial owner, more so in the case of borrowed assets. This intricate chain of custody adds layers of problems regarding investor rights, a point of analysis by the London School of Economics. Source: LSE →

The chain of custody is critical as the alpha and omega of the securities market centers on the question of who truly "holds" the assets. Ultimately, every asset is held by a custodian, who marks both the beginning and the end of a trade's complete lifecycle.

However, short of native tokenization, market participants must work within the frameworks provided. Mainly, the trading of non-native asset-backed tokenized securities will require settlement finality happening at the CSD level who will inevitably be key gateway partners in the development of distributed FMI. The decade long prevailing narrative that the CSD role would be diminished due to tokenization turns moot.

Depositories who employ indirect holdings of securities have a potentially advantageous position in future financial ecosystems due to the fungibility of the assets. Tokenized securities, if designed to be fungible, could extend these benefits into DLT ecosystems, potentially enhancing intraday liquidity.

Different approach, same trap.

Initially, many believed that DLT would outright replace numerous FMIs, leading to a fully native tokenized financial ecosystem. However, this expectation has not materialized. Regulators have clarified that DLT sandbox regimes should be integrated within existing FMIs rather than operate independently, with CSDs serving as the gateway.

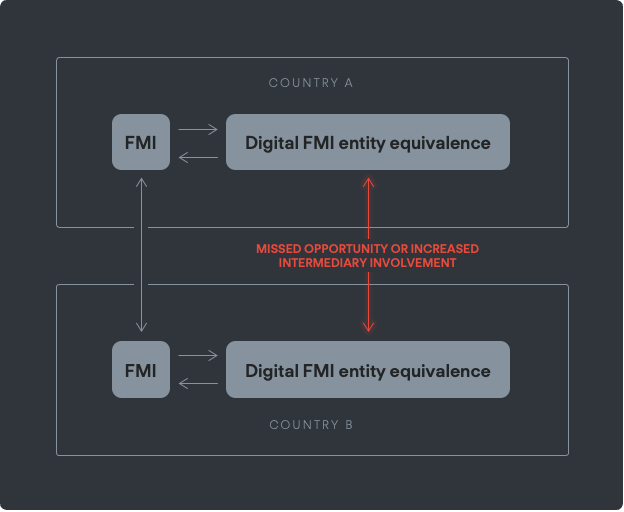

The primary challenge with DLT pilots is that they often operate in isolation as DLT-based FMIs. This creates a siloed environment, failing to address the broader need for integration. For DLT to be truly transformative and result in a permanent regime, its architecture must facilitate seamless connections to non-DLT FMIs, ensuring that DLT participants have equal access to liquidity as their counterparts outside the new technological environment.

Even if such DLT sandbox regimes were successful, additional problems arise with future integration on a cross-border level. In Europe, which has nearly two dozen CSDs, the lack of harmonization continues to be a challenge despite efforts by the European Central Bank’s securities settlement TARGET-2 (T2S) system. This means that DLT pilots for cross-border transactions are destined to face bottlenecks as they are built on top of a disharmonized system. Perhaps, and for good reason, this is why the EU parliament has renewed calls for a single securities supervisor. Source:Risk.net→

ICSDs, already linked globally, are likely the best gateways for DLT platforms. They present several advantages. With fewer ICSDs compared to numerous, disharmonized CSDs, there is a reduced integration burden for FMI participants. This simplifies the process and makes global harmonization more achievable. Additionally, the fact that sandbox regimes have CSDs as the gateway ring-fences the project to potentially be a national initiative, limiting its global interconnectedness. In contrast, ICSDs are inherently designed for global operations, facilitating cross-border transactions more efficiently.

Furthermore, because ICSDs operate with nominee and pooling structures where assets are fungible, their entry into tokenization simplifies reconciliation processes. This fungibility ensures smoother integration of tokenized assets into the existing financial ecosystem.

Without robust integration with financial infrastructure that realizes benefits beyond added costs, DLT-FMIs may end up fragmented, dislocated, and unattractive to market players—issues that have little to do with the underlying technology itself. The same problems about DLT will once again be voiced: lack of interoperability, integration, and scale.

If full-scale interoperability were a goal, the operational burden on exchanges, CSDs, and banks to support all DLT networks and blockchains would be immense, bordering on unachievable. This situation would either force these entities to become digital asset custodians supporting all blockchains and DLT networks (unlikely) or lead to a scenario where a single DLT network is chosen, resulting in vendor lock-in and introducing the notion of network control (i.e., why use a blockchain to begin with?).

While sandbox regimes will be able to showcase speed and portability, the processes resembles current FMIs whereby reconciliation is once again introduced. However, pilots from institutions testing the post-trade settlement process with DLT have highlighted a potential hero participant.

DLT regime market transformation approach

Side note: Obstacles with the first digital CSD.

In 2017, French regulators adjusted their legal framework to accommodate DLT, specifically for the trading and settlement of non-listed securities, recognizing DLT as equivalent to a traditional book-entry system. Europe’s first DLT-based CSD, ID2S, took advantage of this French ordinance but shuttered its doors two years into operation. In an interview with Future of Finance, CEO Andrea Tranquillini stated that one key hurdle was that “ICSDs were understandably reluctant to connect to ID2S as investor CSDs” (an interview → well worth reading). Mr. Tranquillini clarified that despite the Central Securities Depositories Regulation (CSDR) insisting on open access, it does not oblige any CSD to accommodate bilateral links.

More similarities than meets the eye.

The crypto sector, which has faced numerous crises, has had to develop risk mitigation strategies. But the apple didn’t fall very far from the tree with digital asset institutional infrastructure providers porting common structures already seen in FMI.

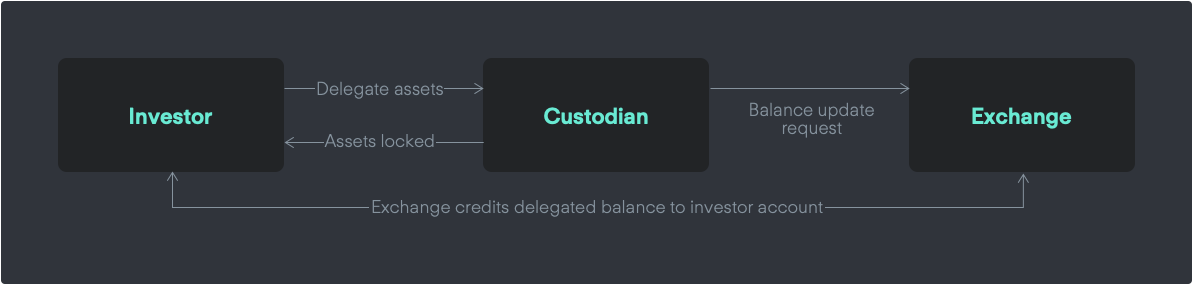

For instance, the downfall of FTX prompted asset managers to move away from storing assets on exchanges that could lead to misappropriation, favoring Off-Exchange Settlement (OES) services provided by their custodians instead. Source: Reuters →

Off-exchange settlement very much resembles the current FMI structure whereby indirect holding models of CSDs require the interaction of custodian banks to administer securities on behalf of the end-investors. Custodian banks often and primarily use omnibus accounts that increases operational efficiencies. Source: Banque de France →

Similarly, OES uses omnibus accounts to lock investor assets and delegate the value onto an exchange without the underlying having to be moved outside custody until settlement (see diagrams).

In OES, matching and preliminary records might be internal, but final settlement requires an on-chain transaction ensuring transparency, speed and security. With current FMI, matching and preliminary records are also internal but final settlement is completed by updating the CSD’s records (settlement window).

Outside of the cryptocurrency sector, digital asset custodians are also proving essential participants for DLT-FMI.

Euroclear, in collaboration with a consortium of banks, experimented with DLT post-trade settlement alongside the Central Bank of France. They found that custodians could reduce and possibly remove the need for reconciliation between market participants for pledged securities tokens. Specifically, custodians who will be able to manage securities wallets on behalf of their clients offers “the most concrete cases of increased autonomy” observed during the experiment. Source: Euroclear →

Euroclear’s pilot isn’t the only institution to highlight the importance of custodians. A whitepaper titled ”Digital Asset Securities Control Principles” published by the DTCC have custodians as the initial source of tokenization and distribution. Source: DTCC →

However, the Banque de France noted a potential issue: “There is a risk…that the current trend of financial market integration could be halted, and that liquidity could become fragmented across multiple non-interoperable systems”. Source: Banque de France →

The question then is how might connectivity be achieved with minimal disruption, the lowest integration cost, interoperable across FMI, no vendor lock-in, and achieve the liquidity and scale financial markets require?

Off-exchange settlement flow*

* The above Off-Exchange Settlement flow is a simplified abstraction from Copper ClearLoop for derivatives.

Risk management structure

** The frequency of settlement is assessed on collateral efficiency and counterparty risk on the realized P&L.

Interoperability and distribution.

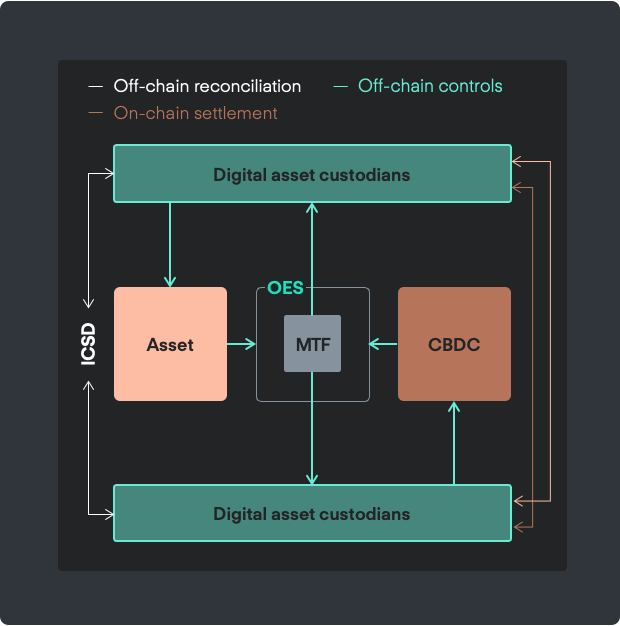

As highlighted by both Euroclear and the DTCC, digital asset custodians can serve markets in the distribution of tokenized securities. The evident problem, of course, is determining which network this would take place on.

Motivated by economic incentives to support as many networks as possible, digital asset custodians can, by default, act as interoperable operators between on-chain and off-chain activities.

For example, assets can be minted, burned, and ported to other blockchains without relying on risky and untested bridges. Off-chain reconciliation would occur at the ICSD level, as prescribed in DLT sandbox regimes (see diagram).

From a technical perspective, this process would resemble the current mint/burn operations for stablecoin issuers who directly engage with cryptocurrency exchanges as the off-ramp.

From an operational perspective, ensuring the fungibility of tokenized securities at the ICSD level enables the seamless integration of DLT-based FMIs with existing legacy systems.

This interoperability ensures that the settlement process remains efficient and compatible across both new and traditional financial systems.

However, while system interoperability facilitates transactions within DLT-FMI, it does not ensure access to global liquidity. This limitation means that participants within DLT-FMI might struggle with liquidity constraints, as their ability to trade with the broader financial market remains restricted.

Potential framework for OES/DLT FMI

Integration and liquidity.

Off-Exchange Settlement (OES) has predominantly been viewed as a risk mitigation service within the crypto sector. However, its hybrid use of technology might have far-reaching potential for resolving integration and thereby liquidity challenges within DLT-FMI.

OES, being blockchain and technology-agnostic, can facilitate linkages of legacy system between traditional FMI and DLT-FMI ecosystems. This improved integration results in an increase in market participation and access to liquidity.

In another sense, real integration across financial markets should allow access to all liquidity and not be bound to the technology the underlying asset is using. Otherwise, it’s not integration as much as it would be fragmentation.

Due to the fungibility of assets at the ICSD, tokenized and non-tokenized securities can be traded in a similar manner. However, while the trading processes for both types of securities are alike, the settlement process will adhere to the traditional post-trade time window. This means that trades of securities that are not both tokenized may face a tradeoff between faster settlement and maintaining liquidity.

The other benefit of such an integration means that exchanges can also avoid the necessity of becoming custodians, as is currently the case for cryptocurrency exchanges. In alleviating this technological and operational hurdle, the opportunity to scale DLT-FMI becomes more realistic.

Scale and capital efficiency.

Scaling DLT-FMI is not just a technological challenge related to network throughput. Achieving scale also requires robust risk management practices to reduce the likelihood of losses and improve capital efficiency that would create network demand.

For OES, the structure is straightforward: assets are locked to cover risks for all parties but remain accessible for trading. This allows investors and exchanges to clear risks at faster rates while using only a portion of their asset value to cover margin requirements. Netting transactions periodically is also feasible (and indeed being executed in crypto OES markets).

This approach contrasts with various on-chain concepts that have been tested that lock assets. For example, the Federal Reserve, the Central Bank of France, the Central Bank of Sweden, and the Bank for International Settlements (BIS) have explored Hash Time-Lock Contracts (HTLC) in their DLT experiments (Sources:1234). HTLCs, however, have significant shortcomings, including issues with scale, privacy, interoperability, security, strategic fails by counterparts, and more importantly, the lack of usability of locked capital .

Netting as a function of security.

The primary role of custodians is to safeguard and segregate assets. Lessons from the crypto markets have shown that custodians will be crucial in mitigating counterparty risk for investors, broker-dealers, and exchanges by executing necessary controls within a regulated risk framework.

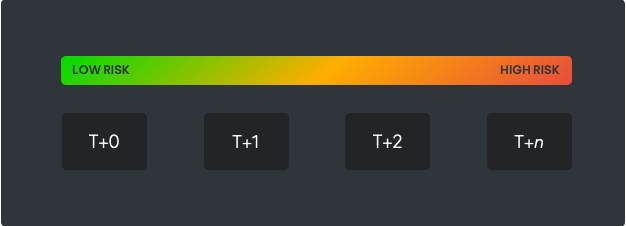

Due to the settlement finality directive, the probabilistic finality offered by most blockchains and DLT conflicts with regulatory requirements.

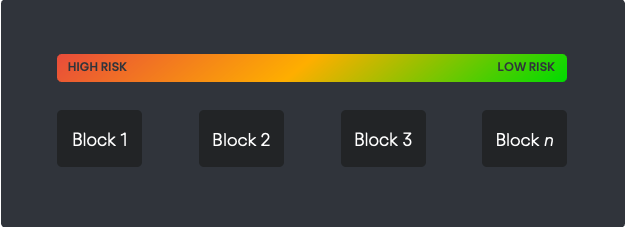

In the U.S. markets, the shift to T+1 settlement has reduced risk by shortening the time until settlement, though it has increased the risk of settlement failures. Conversely, DLT poses higher risks at the real-time transaction level, but these risks decrease as rollbacks become more challenging.

Settlement window

Blockchain transactions

Assets moving on-chain are perceived as having higher settlement finality risk. The increased time helps mute but not eliminate this risk, explaining why DLT pilots often require off-chain reconciliation at the CSD/ICSD level.

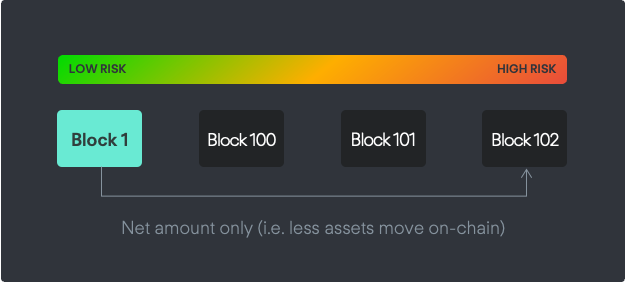

Off-exchange settlement can further reduce these risks. Netting between investors and exchanges means fewer assets need to move on-chain for transactions to be settled. As a result, assets in custody remain at the back of the blockchain, with only a portion (the net amount) moving to the forefront of the ledger, enhancing investor safety and reducing blockchain space demand for all ecosystem participants.

Off-chain netting, on-chain settlement (non-utxo)

Network effects.

The evolution of securities through immobilization and dematerialization sets a precedent, suggesting that tokenization will also progress gradually.

This underscores that the transition to blockchain technology is not an overnight change but a gradual process. Nevertheless, change will come.

Pilot programs for financial technology face the challenge of attempting to completely overhaul the existing financial technology stack all at once. However, there is still a significant gap between theoretical and practical implementation.

Off-Exchange Settlement could offer a model where DLT ecosystems integrate within FMI rather than being segregated and sitting atop them. The latter scenario would reduce liquidity and capital efficiency, which are crucial for creating the participation demand necessary for network effects.

If more assets and liquidity are allowed to flow between both systems, the benefits of tokenized securities will inevitably become evident as more participants opt for faster settlement and the capital efficiencies that result.

OES might not be the final solution to the challenges of DLT-based FMI, but it can serve as the catalyst for a successful beginning. Technology will advance, and regulations will adjust.

Currently, OES could harmonize disparate technologies, addressing interoperability, integration, and scale, potentially elevating sandbox regimes into permanent ecosystems within FMI.

As custodians have been highlighted as key participants by multiple institutions in the development of financial markets – why not leverage the technologies created to address counterparty risk? Efficient capital markets depend on risk management.

Many market participants building DLT-FMI are very focused on instant trading and settlement. However, these are distinctly different activities that don’t need to be bundled and can’t be effective without native tokenization. This ideal is removed from practicality. Trading and then settling separately should be an option, allowing for netting and capital efficiencies. While native tokenized securities, interoperable DLT ecosystems, tokenized central bank money, and access to liquidity will be beneficial, they are far from any realistic timeline.

For now, a tech-neutral path forward is possible.

Download a PDF copy of this in-depth report below.

Disclaimer.

THE INFORMATION CONTAINED WITHIN THIS COMMUNICATION IS FOR INSTITUTIONAL CLIENTS, PROFESSIONAL AND SOPHISTICATED MARKET PARTICIPANT ONLY THE VALUE OF DIGITAL ASSETS MAY GO DOWN AND YOUR CAPITAL AND ASSETS MAY BE AT RISK

Copper Markets (Switzerland) AG (“Copper”) provides various digital assets services (“Crypto Asset Service”) to professional and institutional clients in accordance with the Swiss Federal Act on Financial Services (FinSa) of 15 June 2018 as amended and restated from time to time.

This material has been prepared for informational purposes only without regard to any individual investment objectives, financial situation, or means, and Copper is not soliciting any action based upon it. This material is not to be construed as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any particular trading strategy in any jurisdiction in which such an offer or solicitation, or trading strategy would be illegal. Certain transactions, including those in digital assets, give rise to substantial risk and are not suitable for all investors. Although this material is based upon information that Copper considers reliable, Copper does not represent that this material is accurate, current, or complete and it should not be relied upon as such. Copper expressly disclaims any implied warranty for the use or the results of the use of the services with respect to their correctness, quality, accuracy, completeness, reliability, performance, timeliness, or continued availability. The fact that Copper has made the data and services available to you constitutes neither a recommendation that you enter into a particular transaction nor a representation that any product described herein is suitable or appropriate for you. Many of the products described involve significant risks, and you should not enter into any transactions unless you have fully understood all such risks and have independently determined that such transactions are appropriate for you. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or complete discussion of the risks which are mentioned. You should neither construe any of the material contained herein as business, financial, investment, hedging, trading, legal, regulatory, tax, or accounting advice nor make this service the primary basis for any investment decisions made by or on behalf of you, your accountants, or your managed or fiduciary accounts, and you may want to consult your business advisor, attorney, and tax and accounting advisors concerning any contemplated transactions.

Digital assets are considered very high risk, speculative investments and the value of digital assets can be extremely volatile. A sophisticated, technical knowledge may be needed to fully understand the characteristics of, and the risk associated with, particular digital assets.

While Copper is a member of the Financial Services Standard Association (VQF), a self-regulatory organization for anti-money laundering purposes (SRO) pursuant to the Swiss Federal Act on Combating Money Laundering and Terrorist Financing (AMLA) of 10 October 1997 as amended and restated from time to time. Business conducted by us in connection with the Crypto Asset Service is not covered by the Swiss depositor protection scheme (Einlagensicherung) or the Financial Services Compensation Scheme and you will not be eligible to refer any complaint relating to the Crypto Asset Service to the Swiss Banking Ombudsman.

It is your responsibility to comply with any rules and regulations applicable to you in your country of residence, incorporation, or registered office and/or country from which you access the Crypto Asset Service, as applicable.

The latest forward thinking research, straight to your inbox.

Insights