Copper for Exchanges

Secure infrastructure to scale your operations without limits.

By combining Copper’s Custody, Wallet and Staking solutions, exchanges can process client deposits, optimise their portfolio, facilitate automated withdrawals, and stake assets directly from Copper —all from one platform.

wallets-as-a-service

Streamline your clients’ deposit operations.

Our Wallets-as-a-Service solution facilitates the creation of unlimited proxy wallets, simplifying the reporting and processing of your clients’ digital asset deposits.

- Generate unlimited proxy wallets across 40+ supported blockchains.

- Allocate addresses to each of your clients for streamlined fund tracking

- Upon receiving a deposit at an address, funds are automatically transferred to your secure custody vault.

- The Fees Wallet covers the gas fees for the transactions to your vault account.

40+

supported chains

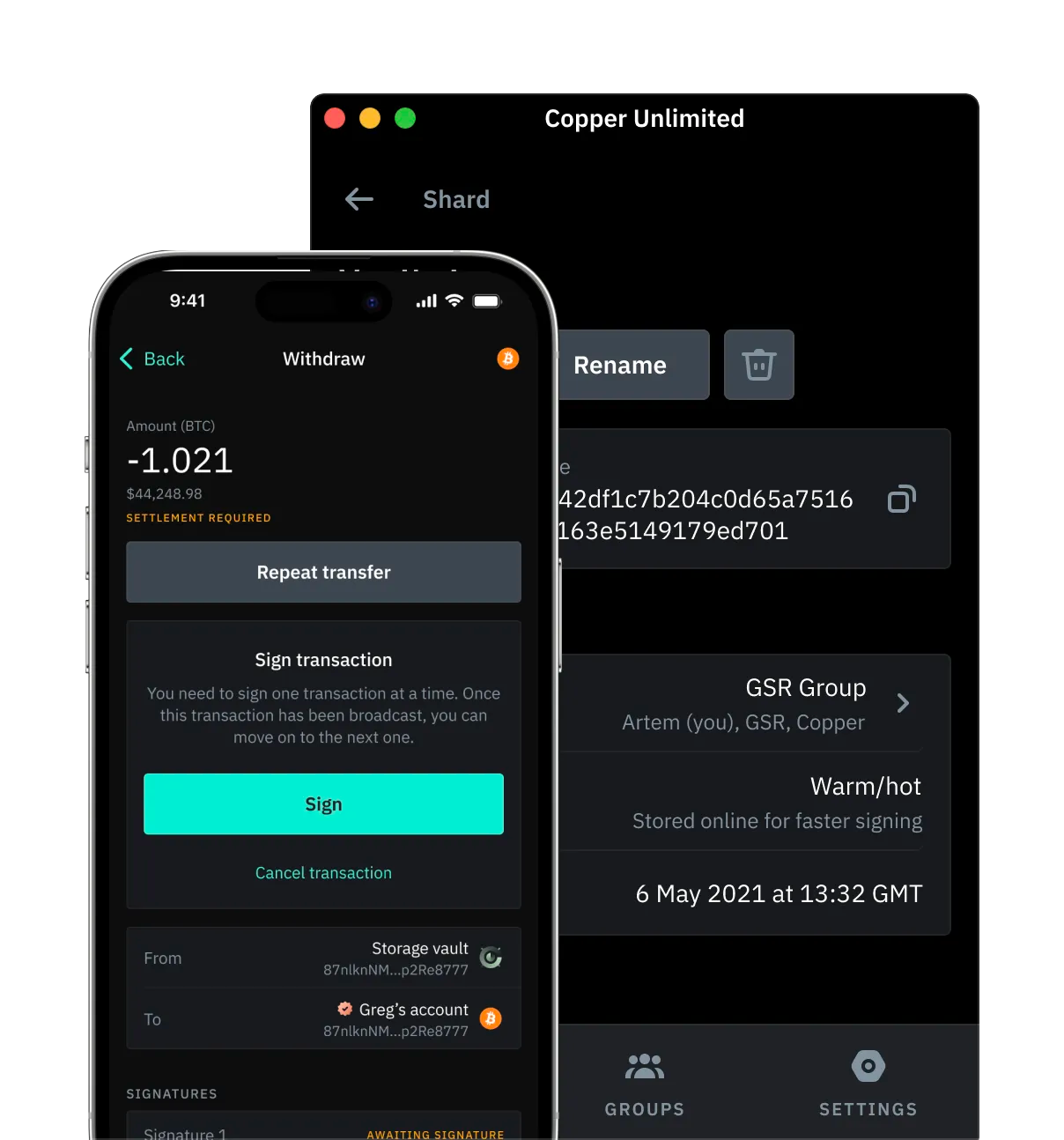

Custody

A tailored custody approach for exchanges.

Leveraging our deep expertise in digital asset security, we've pioneered a custody framework specifically for exchanges:

the waterfall architecture.

Automated rebalancing across hot, warm and cold wallets.

Triggered by predefined thresholds per wallet funds are automatically transferred, optimising operational efficiency

Unparalleled security for clients’ deposits and fast transaction for withdrawals.

Your clients' deposits are automatically redirected to a cold vault, while hot vaults are primed for immediate withdrawals.

Add another layer of security to your treasury with Copper’s Police Engine.

Manage your team member roles, transaction policies, and approval workflows, granting granular control over your operations.

Experts in custody.

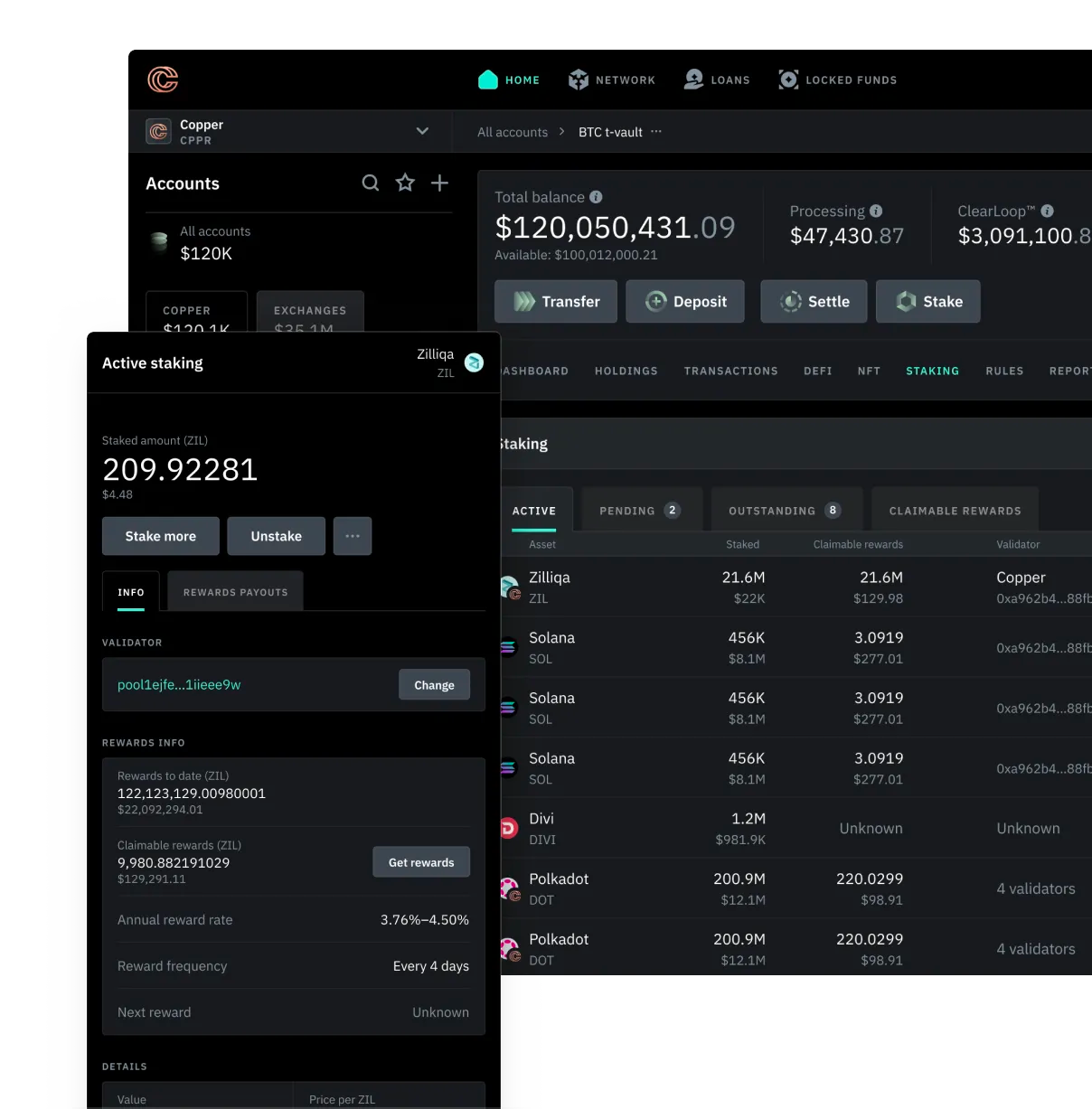

STAKING

Stake your funds in more than 20 chains.

Maximise rewards without sacrificing security, gaining a unique advantage in today's competitive exchange landscape.

Custody-integrated staking.

Stake your assets confidently from any Copper vault, knowing they remain secure in our MPC wallets.

Comprehensive staking dashboard & rewards reporting.

Track your staking positions and rewards effortlessly with our Staking Dashboard, comprehensive API, or downloadable reports.

Control your staking operations.

Set transaction rules, permissions, and approval processes.

*For the Ethereum protocol, assets do leave the MPC wallets. Please note that staking is not available in certain jurisdictions.

MPC. Stake. Reward. Repeat.

Interested in joining the ClearLoop network?

ClearLoop has become an indispensable solution for institutional traders looking to mitigate exchange counterparty risk. Be a part of this growing network to:

- Gain direct access to institutional trading volume.

- Monitor your risk exposure through our analytics dashboards.

- Keep your clients’ assets protected in Copper’s secure infrastructure.

Trusted by the best

In partnership with pioneering institutions.

Alan Howard

Co-Founder, Brevan Howard

Copper's pioneering technology, particularly in the security and speed of cryptocurrency transactions, is essential for the traditional world to offer crypto products to their clients. This positions them as a dominant player for digital asset infrastructure.

Hany Rashwan

Co-Founder and CEO, 21Shares

Safeguarding our digital assets in Copper’s award-winning custody architecture provides us with the best security available on the market. With this foundation in place, we can build more secure ETPs for our clients.

Alessandro Balata

Partner, Fasanara

We’re now able to access greater amounts of liquidity across a growing number of exchanges that are joining Copper’s ClearLoop network. ClearLoop has become a critical component in helping institutional investors mitigate exchange counterparty risk.

See why pioneering institutions use Copper.

Book a demo with a member of our team.