Copper for hedge funds

Access deep market liquidity while keeping your investors’ funds protected.

Copper’s solution for hedge funds eliminates central points of failure, without hampering the investment manager’s ability to access market liquidity securely through centralised exchanges, OTC desks, and DeFi.

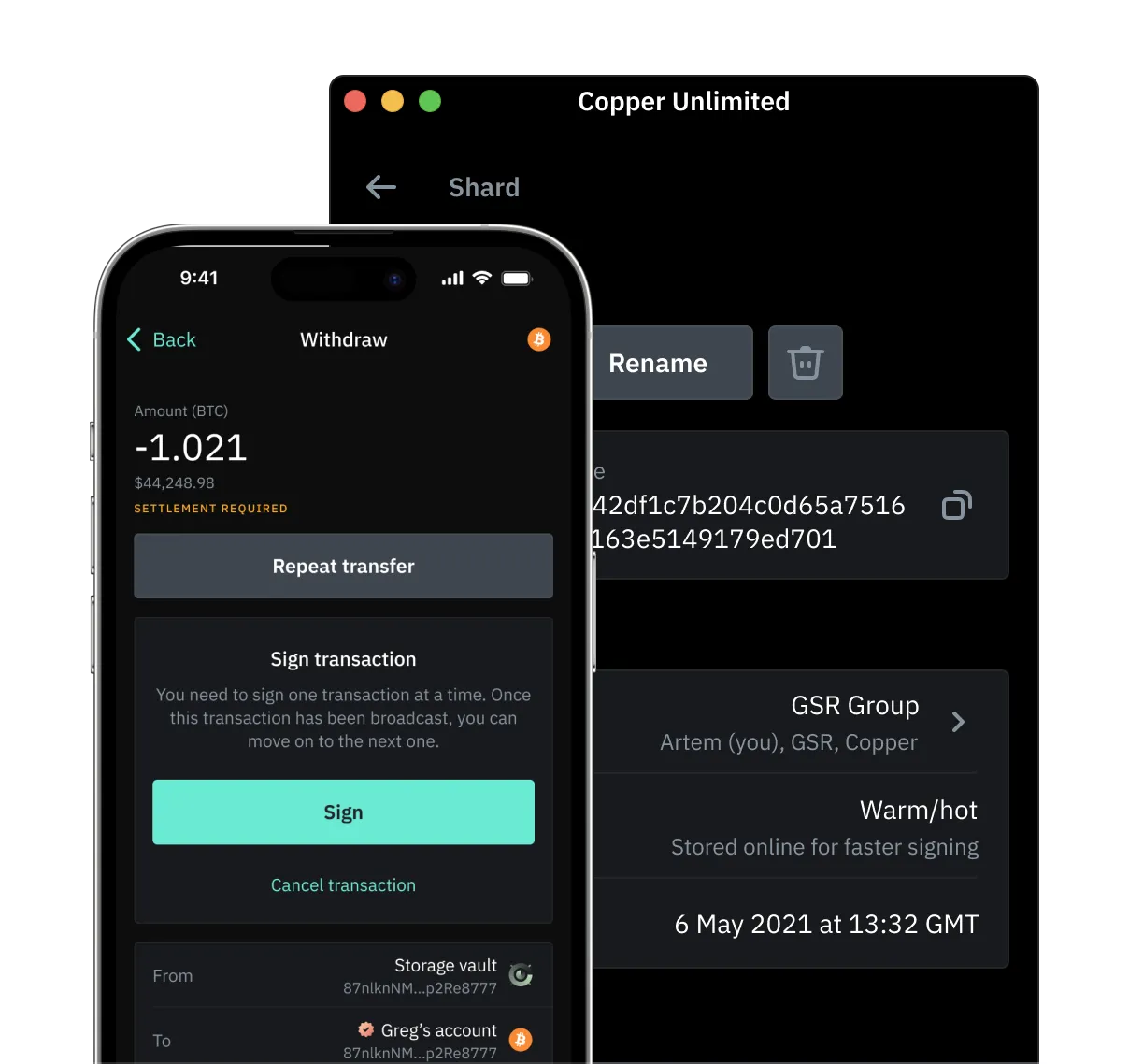

Custody

Protect your investors' funds with Copper’s MPC custody solution.

For limited partners, employing state-of-the-art custody solutions like Copper's, signifies a fund's commitment to security, regulatory compliance, and investor protection.

Eliminating single points of failure.

Copper’s MPC technology underpins all Copper products, eliminating the single points of failure on all your digital asset operations.

Policy engine, an extra layer of security.

Copper’s Policy Engine enables hedge funds to manage team member roles, set transaction policies, and design approval workflows, granting granular control over their operations.

Most-awarded custodian for hedge funds.

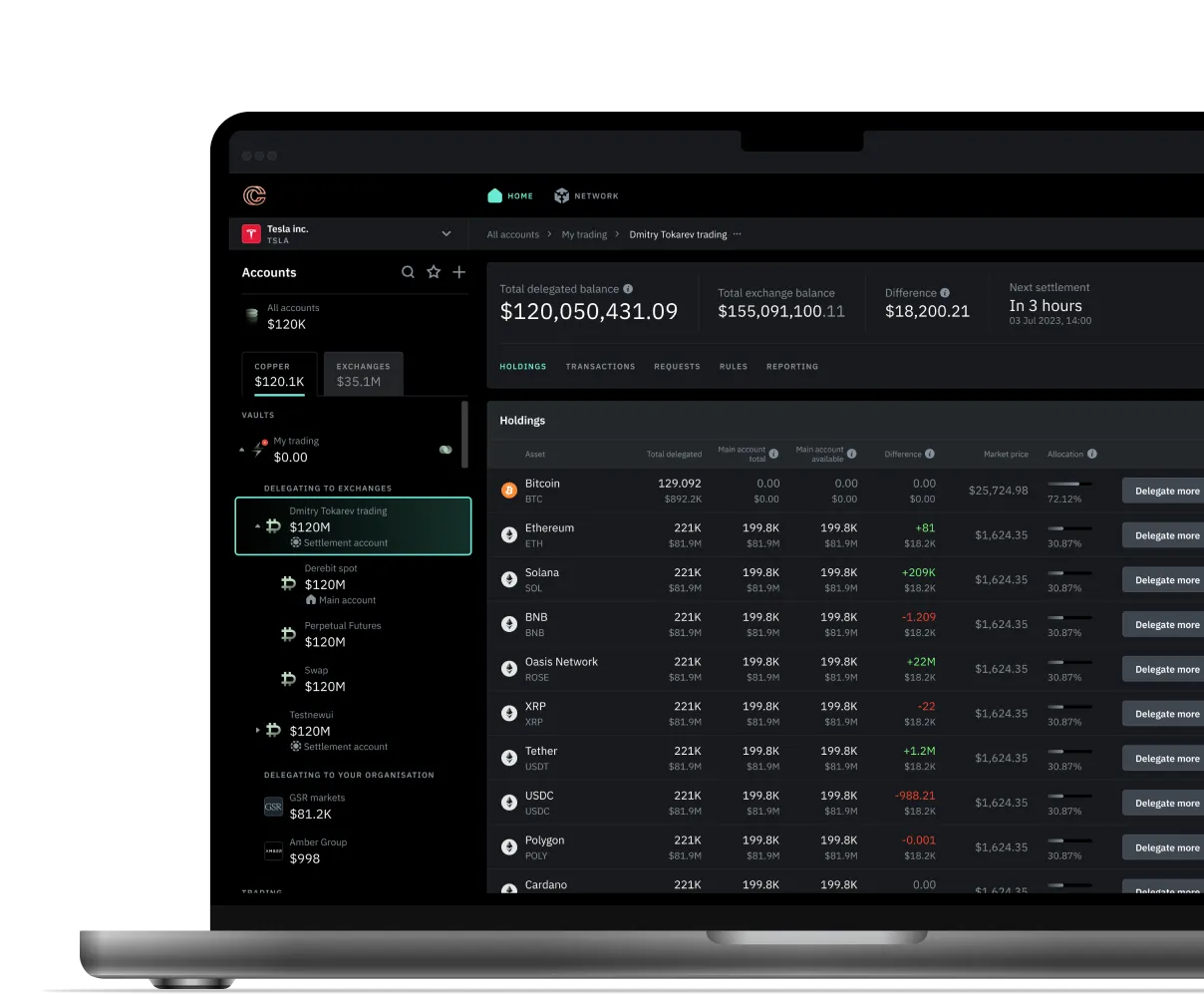

Clearloop

Trade securely on top-tier exchanges, mitigating counterparty risk.

ClearLoop enables clients to access liquidity on multiple exchanges with all settlements occurring within the Copper infrastructure.

Trade while assets remain at Copper.

Collateral never leaves Copper’s secure custody, mitigating the risk posed by holding assets on exchange.

Bankruptcy remote structure.

To mitigate your insolvency risk against Copper, we have established a dedicated account structure for ClearLoop protected by an English Law Trust.

24/7 collateral monitoring.

Copper's risk team ensures that exchanges always maintain sufficient collateral with Copper to satisfy settlement obligations arising from client trading activity.

Increase capital efficiency.

Instantly delegate assets to any supported exchange from a single pool of collateral.

The leading off-exchange settlement solution.

Copper network

Settle your OTC activity with all your institutional counterparties.

Copper Network is the first custodian-agnostic, scalable, and private digital asset settlement network.

Build your own private network and settle with the major liquidity providers in the market.

Manage your OTC connections and settle with any institutional counterparties, regardless of where they custody their assets.

Settle with greater flexibility.

Our flexible settlement network tackles scalability issues, risks, and inefficiencies associated with one-way transfers in trade settlements.

More than just a transfer network.

Trusted by the best

In partnership with pioneering institutions.

Alan Howard

Co-Founder, Brevan Howard

Copper's pioneering technology, particularly in the security and speed of cryptocurrency transactions, is essential for the traditional world to offer crypto products to their clients. This positions them as a dominant player for digital asset infrastructure.

Alessandro Balata

Partner at Fasanara Capital

We’re now able to access greater amounts of liquidity across a growing number of exchanges that are joining Copper’s ClearLoop network. We have tremendous flexibility to move and manage our assets all while remaining within Copper’s secure custody. ClearLoop has become a critical component in helping institutional investors mitigate exchange counterparty risk.

Michael Hall

CIO & Co-founder

With Copper’s advanced security settings, we can run a fund called the multi-manager fund, enabling multiple managers to manage custody themselves knowing that money is safe, that money can’t be moved off the exchanges or out of the wallets and it stays within the Copper’s infrastructure, another benefit of using Copper.

See why pioneering institutions use Copper.

Book a demo with a member of our team.