Copper for Trading Firms

Scalable custody and post-trade services for trading firms.

Securely connect with exchanges, OTC counterparties, and DeFi dApps, streamlining post-trade settlement activities and reducing back- and middle-office workloads.

Clearloop

Provide and access liquidity on ClearLoop connected exchanges.

Trade while assets remain at Copper.

Collateral never leaves Copper’s secure custody, mitigating the risk posed by holding assets on exchange.

Bankruptcy remote structure.

To mitigate your insolvency risk against Copper, we have established a dedicated account structure for ClearLoop protected by an English Law Trust.

24/7 collateral monitoring.

Copper's risk team ensures that exchanges always maintain sufficient collateral with Copper to satisfy settlement obligations arising from client trading activity.

Increase capital efficiency.

Instantly delegate assets to any supported exchange from a single pool of collateral.

The leading off-exchange settlement solution.

Copper network

Settle your OTC trades with all your institutional counterparties.

The first custodian-agnostic, scalable, and private digital asset settlement network.

Settle with your counterparties regardless of where they custody their assets.

The Copper Network is accessible to both Copper clients and their counterparties, including those external to Copper.

Scale your operations with unified post-trade communications and workflows.

Centralise your entire settlement lifecycle on the Copper Platform and eliminate the need for manual daily reconciliations, easing the workload in both back- and middle-office operations.

Grow your network.

Network participants can request to be publicly displayed on our Platform. This visibility not only enhances their market presence, but also leads to developing new connections.

More than just a transfer network.

treasury management

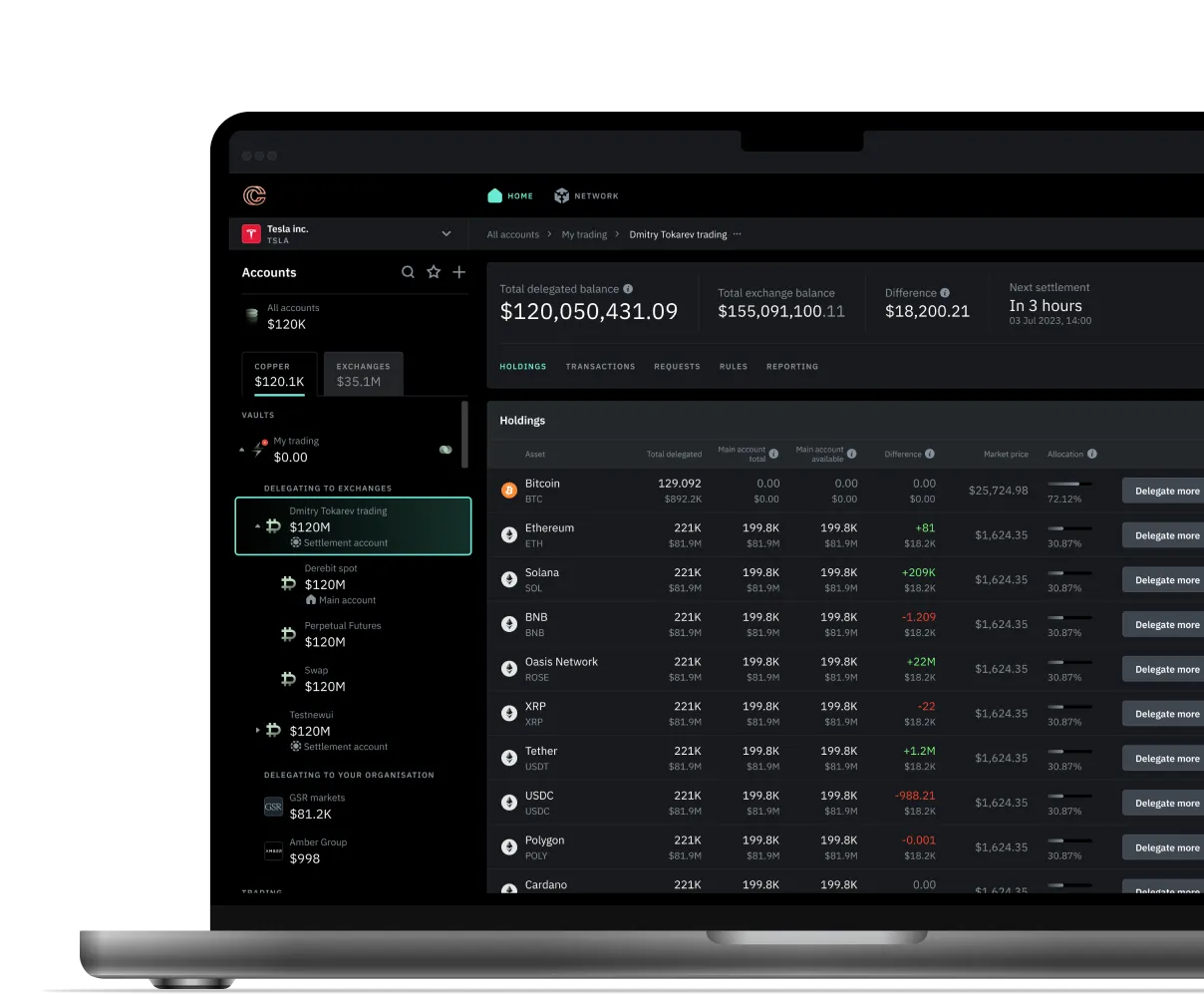

Manage your Copper and exchange accounts from one platform.

Oversee you asset holding and streamline middle-office workflows using our automated capabilities.

Manage your portfolios effortlessly through Copper.

Conduct every-day treasury operations with a unified view of your Copper and exchange accounts.

Optimise your treasury operations.

Streamline your treasury operations with Copper's automation capabilities.

Securely transfer assets across multiple accounts.

By implementing whitelisted address controls, Copper clients can establish a secure, permissioned environment for asset movement.

Your treasury optimised.

Custody

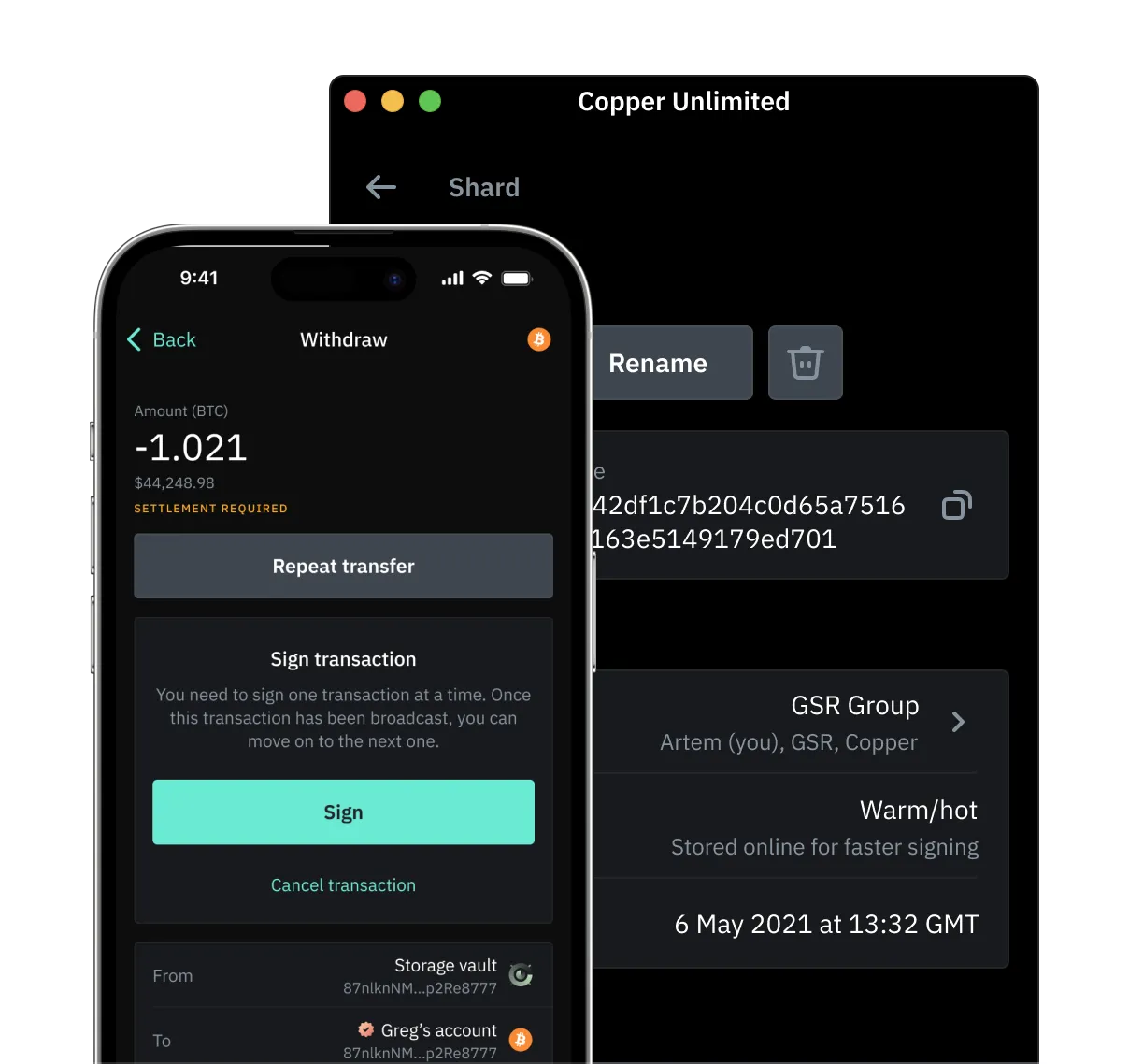

Secure your assets with Copper’s MPC-protected custody.

Your platform to access the market securely.

Eliminating single points of failure.

Copper’s MPC technology underpins all Copper products, ensuring that your funds are never exposed to a single point of failure.

Policy engine, an extra layer of security.

Manage your team member roles, set transaction policies, and design approval workflows, granting granular control over their operations.

Maximum security without compromising control.

DeFi

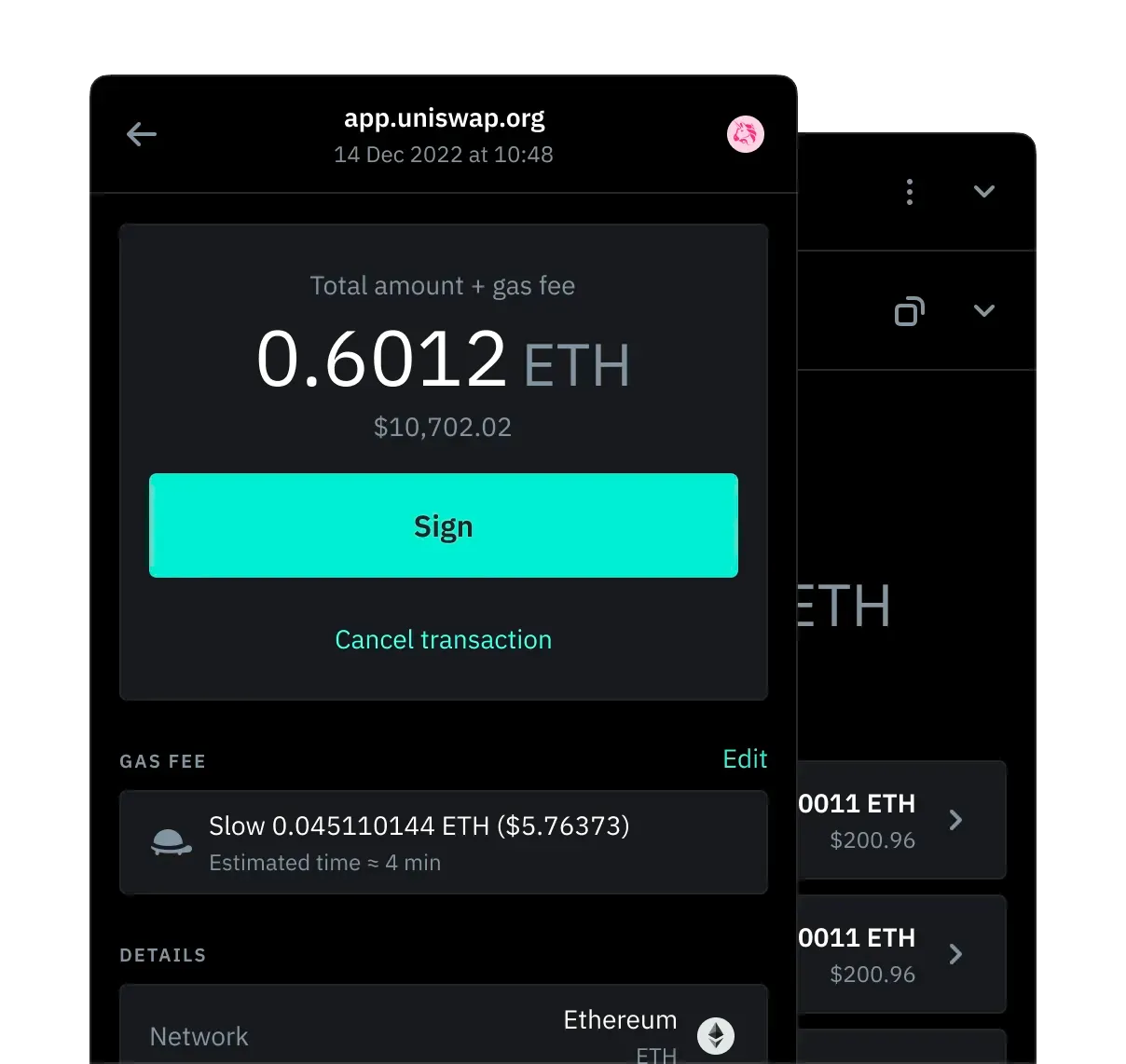

Explore DeFi strategies with Copper’s MPC-protected wallets.

Deploy capital into smart contracts using MPC protected wallets, eliminating single-point-of-failure risks in private key management.

Connect with EVM and non-EVM blockchains.

Untap investment opportunities across 10 Chains & 15K+ decentralised applications.

Explore DeFi strategies with Copper’s MPC protected wallets.

Our DeFi Connectivity offers institutional investors the ability to engage with blockchain smart contracts using our wallet or API.

Trusted by the best

In partnership with pioneering institutions.

Annabelle Huang

Managing Partner at Amber Group

Through the Copper Network, a secure and efficient custodian-agnostic settlement solution, our clients can settle with any institutional counterparty, regardless of their current custody provider. This collaboration bolsters the capital efficiency and security of our funds, providing our clients with peace of mind as they engage in trading activities.

Jack Yang

Founder and CEO at LTP

The collaboration with Copper.co allows us to offer a comprehensive and secure prime brokerage solution. ClearLoop is a state-of-the-art off-exchange settlement solution that provides our clients with the peace of mind knowing their assets are safe and secure. By combining LTP's liquidity solutions with Copper.co's ClearLoop, we are creating a unified ecosystem that enhances liquidity, robust security, and seamless trading experiences, benefiting our valued users.

Michael Rabkin

Partner at DV Chain

We've had the pleasure of working with Copper pretty much since their inception. Longevity and continuous innovation are two things that most companies strive for, and Copper seems to have these engrained in their values. Being one of the largest global custodians for crypto assets, Copper continues to innovate products, creating a much smoother and more efficient process for their clients.

See why pioneering institutions use Copper.

Book a demo with a member of our team.