Market Insights

Copper’s Weekly Update – 26 October 2020

Highlighting what went right, and what went wrong, in this week’s crypto news analysis.

Looking back at last week’s biggest news, including price analyses for BTC, ETH, and XRP.

It was a milestone week for digital assets. Let's recap.

Bitcoin has surged more than 70% year-to-date, and PayPal's announcement that it would allow its users to buy, sell, and exchange the asset served as another key endorsement for the asset. Just days after confirming it would soon accept Bitcoin and a handful of other digital assets, PayPal reportedly is in talks to acquire cryptocurrency companies.

Meanwhile, JPMorgan continues to demonstrate bullish sentiment for Bitcoin. On Friday, the investment banking giant’s Global Quantitative and Derivatives Strategy team wrote a note to clients commenting that Bitcoin has proven itself to be a risk asset with ‘considerable’ potential upside.

This bullish sentiment was mirrored by Grayscale. CEO Barry Silbert tweeted on Thursday that the digital asset manager had acquired an additional $300 million in cryptocurrencies over the the course of 24 hours. The firm now has a record $7.3 billion in total AUM.

Tuesday was a historic day for The Bahamas. The digital Bahamian dollar, known as the Sand Dollar, went live nationwide. And there you have it - the first country in the world to officially roll out a CBDC!

Finally, our latest Coppercasts episode is now online, with Iain Wilson from the NEM Project joining us to talk about the future of tokenisation, and how the NEM protocol is positioned to reshape financial markets infrastructure.

PayPal allows Bitcoin and crypto spending

From early next year, PayPal will allow its 346 million users to buy, hold and sell cryptocurrency directly from their PayPal account.

The entry of Paypal in the crypto industry sent the value of bitcoin soaring on Wednesday.

CME’s rise in Bitcoin futures rankings signals growing institutional Interest

The Chicago Mercantile Exchange (CME) has become the second-largest derivatives market for Bitcoin futures in terms of open interest. The exchange has seen an influx of demand since the recent Paypal announcement and the Bitmex saga as well.

At the start of the year, the exchange accounted for a meagre 4% of the global open interest.

PBoC seeks to revise banking law to legalise digital yuan and ban yuan-pegged tokens

The People's Bank of China (PBoC) is soliciting public feedback on a proposed law that would ban stablecoins, except for the central bank’s digital currency.

Many Chinese investors currently conduct crypto-to-crypto trading with stablecoins. Tether, one of the largest crypto companies, has a yuan stablecoin.

Latest Coin News

BTC

- Price Analysis: BTC/USD eyes $15K, overbought conditions warrant caution.

- Will the dollar’s weakness result in Bitcoin finally breaking $12,000?

- Bitcoin's price just hit a new high for 2020. Read morePaul Tudor Jones says he likes bitcoin even more now, rally still in the ‘first inning.

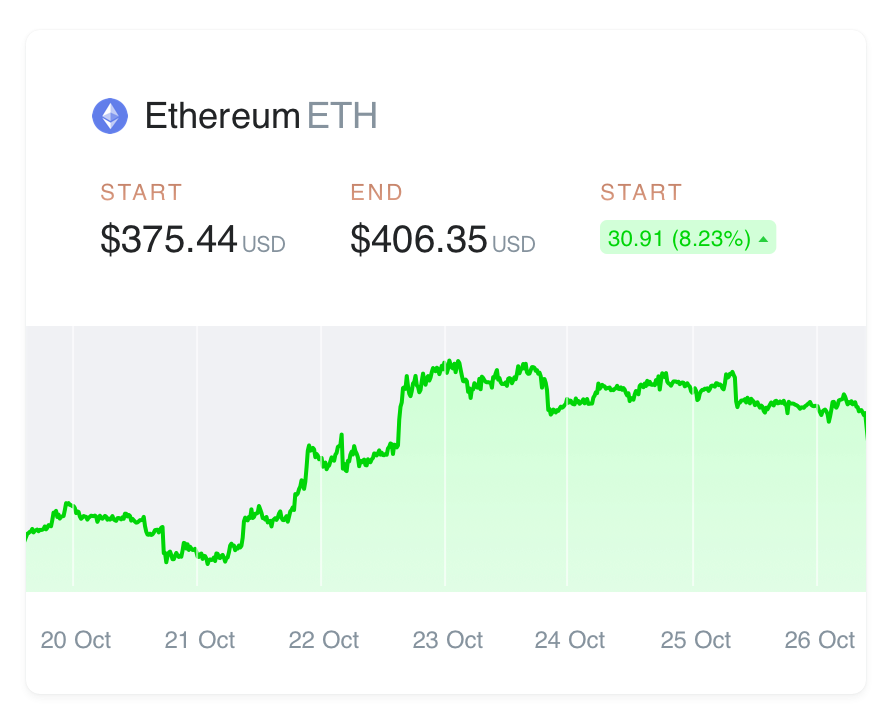

- Price Analysis: ETH has a good chance to clear $420 as miners stick to HODLing.

- Ethereum set to become first blockchain to settle $1 trillion in one year.

- Ethereum 2.0 Deposit contract release kicked back until November.

XRP

- Price Analysis: XRP is ready to break out amid massive exchange outlfows.

- Ripple eyeing move to London over XRP-friendly stance, CEO says.

- Ripple executive explains why PayPal is excluding XRP from new crypto business.

Subscribe today to receive these updates directly to your inbox every Monday morning.

The latest forward thinking research, straight to your inbox.

Insights