Market Insights

Only a fraction of institutional investors keep crypto funds SAFU in custody

It’s 3 a.m. Do you know where your digital assets are? Apparently 92% of institutional investors do not.

Over 92% of institutional investors leave themselves at severe risk by failing to secure their crypto funds with external custody services.

The second edition of Binance’s Institutional Market Insights collected responses from 76 funds, market makers and institutions with digital asset allocations ranging from $100,000 to $25m.

“Exchanges remain the most popular choice for cryptoasset storage amongst our institutional clients,” Binance found.

[caption id="attachment_4204" align="alignnone" width="512"] Binance Institutional Market Insights (2nd Edition)[/caption]

The researchers continued: “When moving to self-storage, cold wallets are the second most favoured choice, given their improved safety and control. Third-party custody services were the least popular option at 2.6%.”

Follow the money

These numbers will surprise many in the industry. Asset managers and those charged with protecting institutional funds would be shocked by the lack of protections their clients have in place.

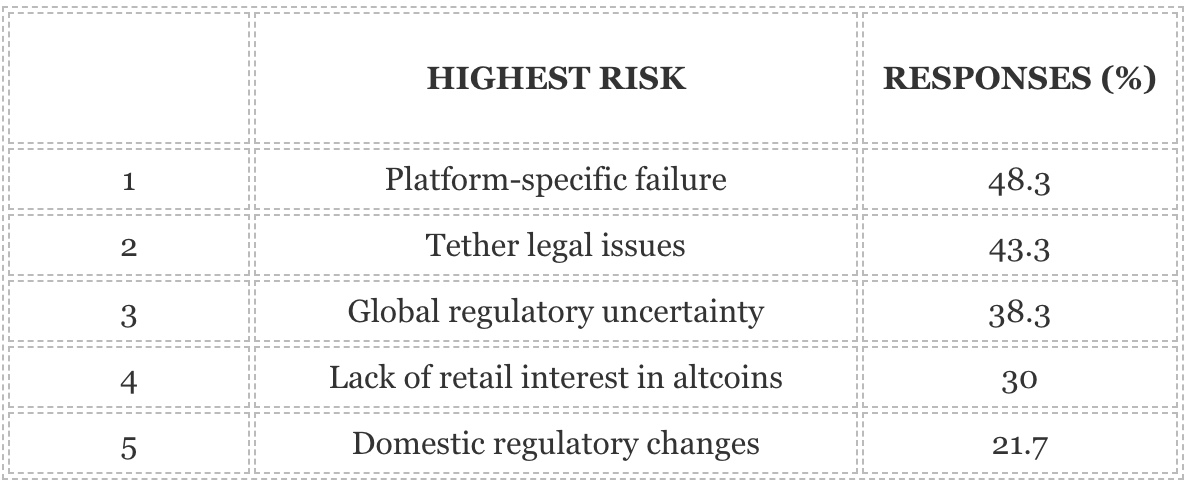

This is especially true given that platform-specific failures — including exchange hacks — topped the list of risks that concerned most participants, with over 48% saying this was the main industry problem.

HIGHEST RISKRESPONSES (%)1Platform-specific failure48.32Tether legal issues43.33Global regulatory uncertainty38.34Lack of retail interest in altcoins305Domestic regulatory changes21.7

“Past exchange failures, such as Einstein Exchange or Mt. Gox, remain a top concern as most trading activity remains on centralised platforms,” Binance’s research arm said.

Binance itself has suffered this fate. May 2019 saw criminals steal 7,000BTC from the Malta-headquartered exchange.

And Einstein is the latest Canadian exchange to collapse, just months after the well-publicised QuadrigaCX debacle. The British Columbia Securities Commission seized control of the Vancouver-registered exchange after it reported plans to fold, owing clients $12.4m.

Receivers Grant Thornton — who also took charge of failed New Zealand exchange Cryptopia and famously found that venue failed to separate client funds into individual wallets — discovered Einstein’s management had just $34,000 left in fiat and cryptocurrency after a financial review.

Under lock and key

If investors do not have direct access to the keys that unlock their account, their funds can simply be frozen by failed exchanges. And few trading venues are strong enough or established enough to ride out multi-million dollar hacks.

Just three out of more than 160 spot exchanges received an AA rating in CryptoCompare’s Q3 2019 market report: Gemini, ItBit and Coinbase. And analysts at the London insights firm found a minuscule number of trading venues used an external custodian service to protect client funds.

In Q3, only 4% of all exchanges had a formally approved cybersecurity certification, despite the continued hacks that continue to plague crypto exchanges.

While exchanges are diversifying their product offerings, with 10% more now offering some level of margin trading, the vast majority are still not using accredited custody providers, or offering the kind of industry-standard insurance against losses that is expected elsewhere in the financial sector.

“Despite a proliferation of high-profile custody providers entering the market, only 8% of exchanges use a custody provider to store user assets, while only 4% of exchanges offer third-party insurance in the event of a hack,” CryptoCompare found.

Copper Comments

It's clear the industry has not learned from the mistakes made by retail investors over the last decade. While exchanges are making huge strides in securing their user's assets, for institutions this doesn't tick all the boxes.

It's for this reason the Copper Walled Garden was created in the first place. Built on top of award winning cold storage architecture, the Copper infrastructure eliminates the risk of internal fraud, allows asset managers to trade more quickly and more securely, and provides game changing optical air-gapping.

For more information about about our products and services, please get in touch with the team.

The latest forward thinking research, straight to your inbox.

Insights