Market Insights

Why corporate treasurers are increasingly considering Bitcoin

Our CFO Ralph Payne explains the case for putting Bitcoin on corporate balance sheets

This article was originally published in Digital Bytes - March 31st edition

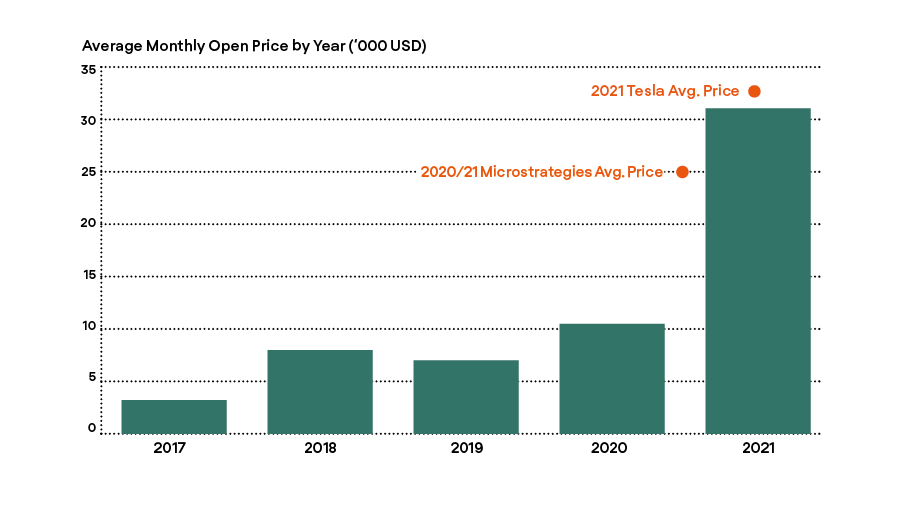

It has been seven months since business intelligence firm Microstrategy became the poster child for corporate support of Bitcoin after putting the crypto into its treasury reserve. The first publicly listed company to do so.

Since then, a slew of companies have followed the firm’s bold lead. According to the web portal bitcointreasuries.org, there are currently 51 corporations that hold Bitcoin on their balance sheets – 32 of which are publicly traded.

The most prominent on the list is of course Tesla, the world’s sixth most valuable company, which announced its impressive $1.5bn investment in Bitcoin in early February.

Since the Tesla news, Twitter Finance Director Ned Segal disclosed that the social media giant is considering joining the bandwagon, while a research note from the Royal Bank of Canada has made an argument for why it would benefit Apple. Square also said that it had made a $170m investment in Bitcoin in the most recent quarter, where the previous quarter’s purchase had been about $50m.

The reasons for allocating a portion of corporate treasury to Bitcoin are multifaceted and debated, but it essentially boils down to belief that the cryptocurrency is more likely to hold its value going forward than the dollar.

At a time of ultra-loose monetary policy and record-low interest rates, corporates are scrambling for alternatives to better invest their cash.

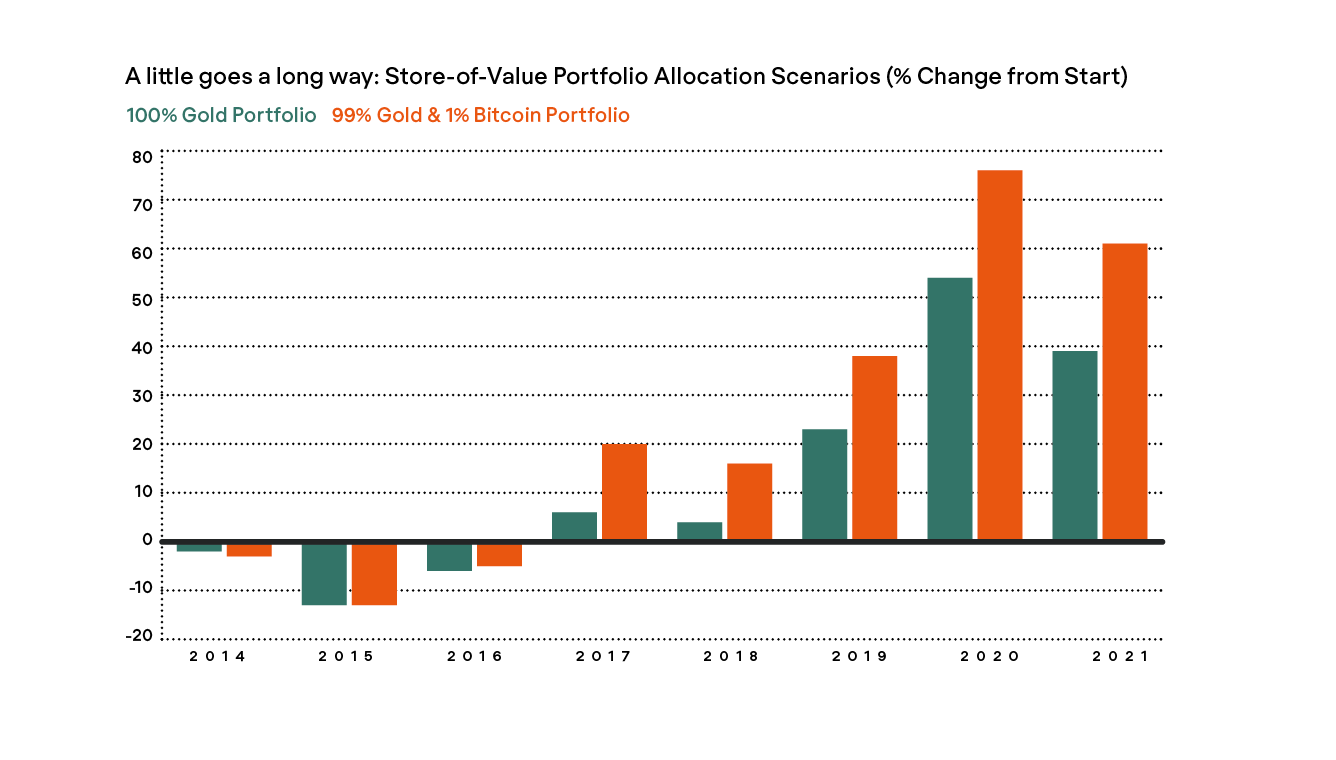

Enter Bitcoin. In addition to being historically uncorrelated to equities and bonds, the asset has the potential to diversify a portfolio while generating phenomenal returns.

Given the cryptocurrency’s notorious reputation as a volatile asset, it may seem like an unorthodox choice. Duke University economics professor, Campbell Harvey, believes it doesn’t really make sense for companies to convert cash to Bitcoin, telling the Financial Times: “It’s unusual, it’s risky and it won’t necessarily provide that hedge that they are looking for.”

However, at a time when a great deal of companies have hoards of extra cash sitting on their balance sheets earning diminished returns in the current low-yield environment, Ralph Payne, CFO at Copper, believes the appeal of Bitcoin is clear.

“Historically, corporate treasuries have managed cash conservatively, by allocating spare cash not required for operations to low-risk assets. However the evolving economic climate is promoting a growing roster of companies to consider Bitcoin.”

“This is primarily owing to the cryptocurrency providing gains in every calendar year except for 2014 – the only year so far in which Bitcoin ended lower than it started. The fact that Bitcoin has appreciated enormously in most other years makes the asset a relatively secure hedge if you’re holding it for the long-term.”

After Tesla, what next?

There are many companies that could potentially add Bitcoin to their corporate treasury.

S&P 500 companies are currently sitting on more than $1 trillion in cash, with tech companies such as Amazon, General Electric, Apple, Oracle and Alphabet boasting the largest cash piles.

Ralph Payne, CFO at Copper believes the recent slate of companies adding Bitcoin to their balance sheets reflects a fundamental change, given how unthinkable this would have been a couple of years back.

Portfolio-Allocation

“Companies are very cautious when it comes down to their reserves. This doesn’t appear to be a flash in the pan, but a major turning point for the sector.”

“At Copper, we are seeing signs of potential new demands coming from corporations. Toward the end of January 2021, I led a webinar hosted by the Association of Corporate Treasurers (ACT) to discuss Bitcoin as a reserve asset. We were in awe by the sheer volume of queries and interest from corporate treasurers, and are now organising a follow-up session to answer the dozens of questions that were not addressed.”

“In my view, it will only be a matter of time until more corporations follow in the footsteps of Telsa and Square, especially as more companies start to offer crypto services or accept crypto payments. We’re extremely excited about this next phase of the cryptoasset evolution.”

The latest forward thinking research, straight to your inbox.

Insights