Copper for Venture Capital Funds

Cultivating strategic relationships within the blockchain ecosystem.

At Copper, our approach transcends traditional custody solutions. We actively establish strategic alliances with venture capital firms and their portfolio companies to enhance growth and innovation within the blockchain space.

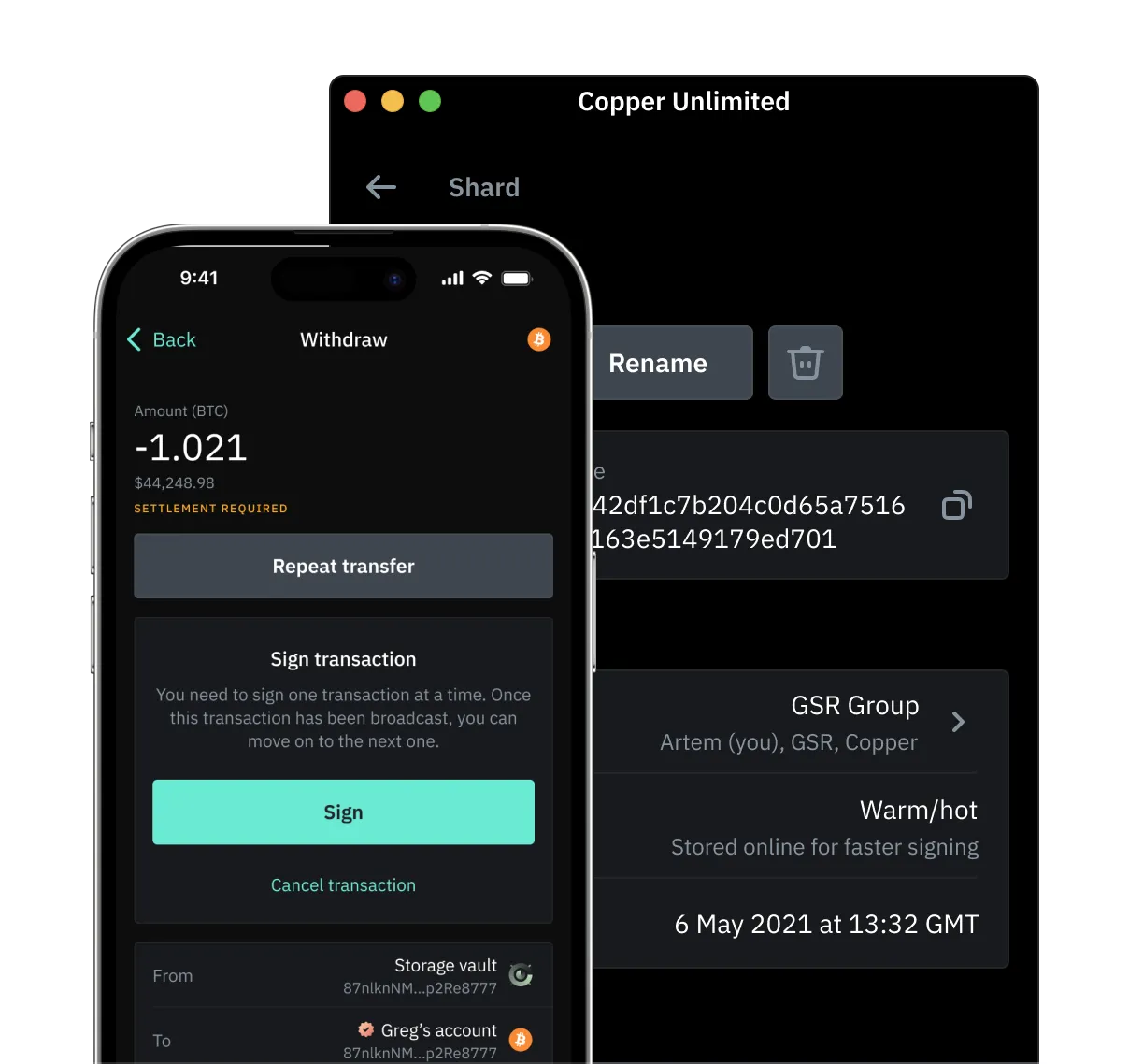

Custody

Protect your investments with our award-wining solution.

Copper’s MPC technology underpins all Copper products, eliminating single points of failure on all your digital asset operations.

Hold assets on 50+ blockchains.

We support 600+ tokens and can add new assets swiftly as per your requirement. Check our coverage

Policy engine, an extra layer of security.

Manage your team member roles, set transaction policies, and design approval workflows, granting granular control over their operations.

Eliminating single points of failure.

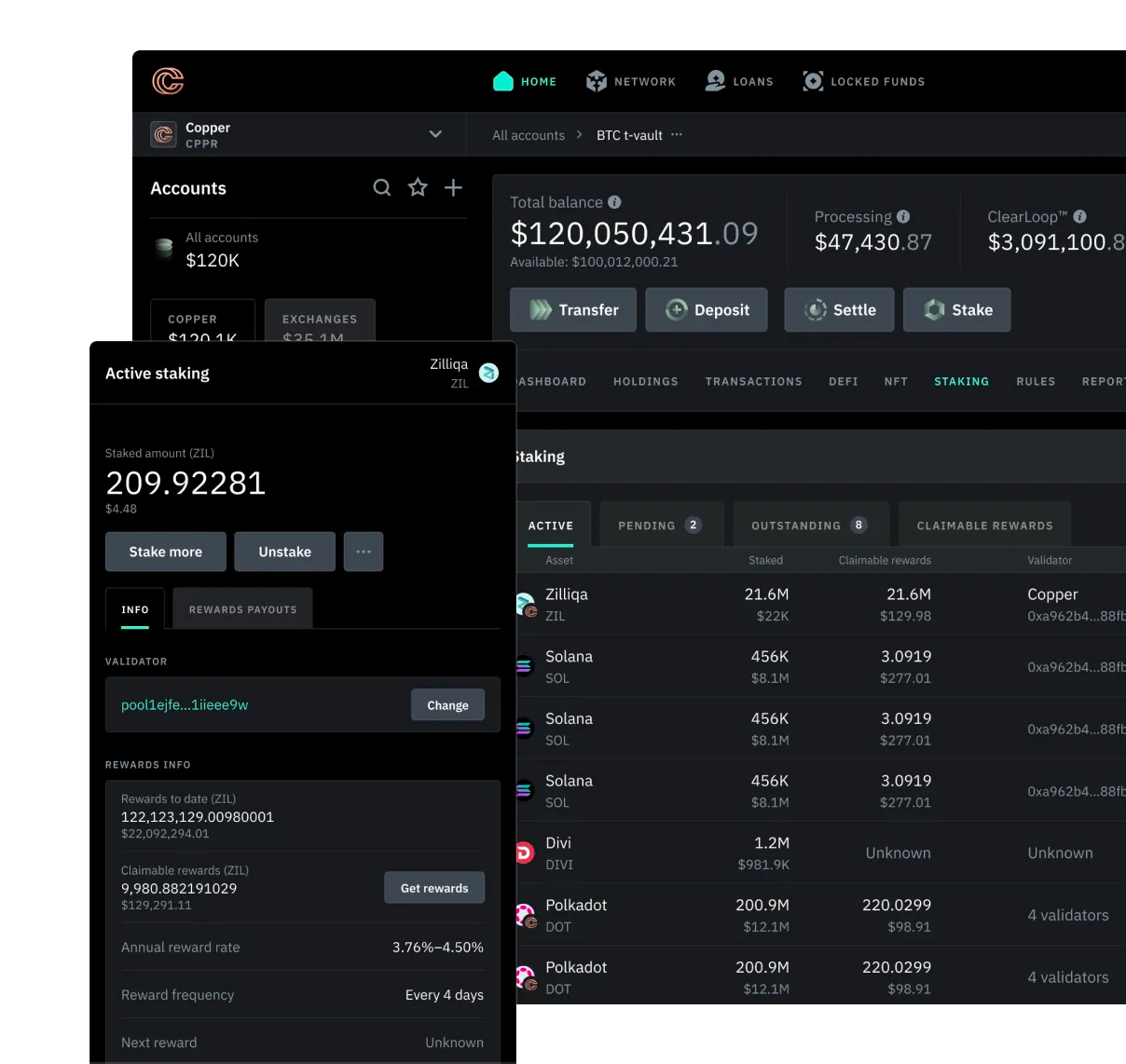

Staking

Generate rewards from your long-term investments.

Stake your assets to validator nodes across 20 blockchains, transforming static holdings into active revenue streams.

Custody-integrated solution.

Stake your assets directly from your vault, knowing they remain secure in Copper's Multi-Party Computation (MPC) wallets.

Comprehensive staking dashboard & rewards reporting.

Track your staking positions and associated rewards effortlessly with our Staking Dashboard or API.

*For the Ethereum protocol, assets do leave the MPC wallets. Please note that staking is not available in certain jurisdictions.

MPC-protected rewards.

ClearLoop & Network

Access market liquidity directly from OTC desks and market makers.

Settle with your institutional counterparties regardless of where they custody their assets.

The Copper Network is accessible to both Copper clients and their counterparties, including those external to Copper.

Mitigate exchange counterparty risk with ClearLoop.

Trade on centralised exchanges while funds stay in Copper’s secure MPC custody and further protected by an English Law Trust.

Unlock new partners.

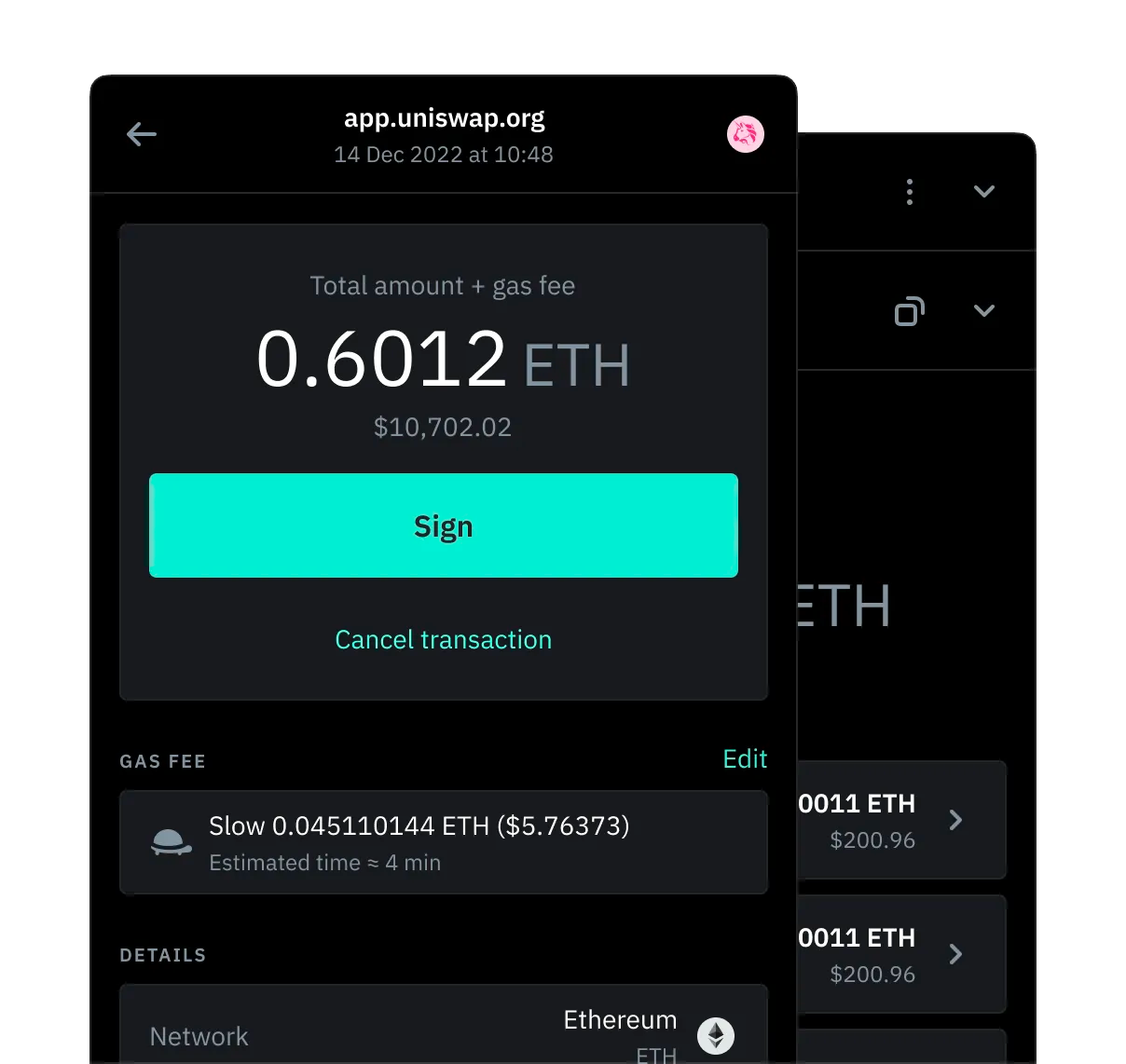

DeFi

Participate in on-chain activities protected by MPC.

Vote in governance proposals and interact with thousand of dApps from Copper’s DeFi connectivity.

Connect with EVM and non-EVM blockchains.

Interact with dApps in 10+ chains through Copper Connect or our DeFi API.

Participate in governance activities.

Our DeFi Connectivity offers institutional investors the ability to engage with blockchain smart contracts using our wallet or API.

Vote, swap, lend, borrow.

Trusted by the best

In partnership with pioneering institutions.

Alan Howard

Co-Founder, Brevan Howard

Copper's pioneering technology, particularly in the security and speed of cryptocurrency transactions, is essential for the traditional world to offer crypto products to their clients. This positions them as a dominant player for digital asset infrastructure.

Hany Rashwan

Co-Founder and CEO, 21Shares

Safeguarding our digital assets in Copper’s award-winning custody architecture provides us with the best security available on the market. With this foundation in place, we can build more secure ETPs for our clients.

Alessandro Balata

Partner, Fasanara

We’re now able to access greater amounts of liquidity across a growing number of exchanges that are joining Copper’s ClearLoop network. ClearLoop has become a critical component in helping institutional investors mitigate exchange counterparty risk.

See why pioneering institutions use Copper.

Book a demo with a member of our team.