Perhaps unsurprisingly, the majority of queries touched on cryptocurrencies and blockchain technology. Mr Carney declined to offer financial advice to a few nervous investors wary of Brexit and the US trade war’s effect on a volatile FTSE 100, but he was able to go into detail on his views on cryptocurrencies, blockchain, and the Bank’s role in the ever-more-popular idea of producing a central bank digital currency.

One pertinent question from user Fred Needle went: “Does he envisage one of the types of IMF SDRs [Special Drawing Right] to become a global currency in his lifetime? If so, will it be crypto/blockchain/gold-backed?”

Carney replied: “The IMF’s SDRs...are not intended to become a widely accepted means of exchange – what most people understand ‘currency’ to mean. That said, I think it is likely that we will ultimately have reserve currencies other than the USD.”

Special Drawing Right is the IMF’s alternative reserve asset. Its value is calculated based on the US dollar, the Euro, Britain’s pound sterling, the Chinese yuan and Japan’s yen.

Rumours of an ‘IMFCoin’ - basically the SDR but secured on a blockchain - have persisted ever since head of the IMF, Christine Lagarde, spoke to a Bank of England Forum in October last year, saying that “it is not a far-fetched hypothetical” that the SDR could take over from the world’s most-recognised currencies.

Lagarde, warned in 2017 that central banks should be taking cryptocurrencies very seriously. "The ways in which new technologies are lowering the cost to make financial transactions more accessible, even in very small numbers…I think it’s already massively disruptive,” she said.

As recently as November 2018 she has said that central banks should consider releasing their own digital currencies. “The advantage is clear. Your payment would be immediate, safe, cheap and potentially semi-anonymous... And central banks would retain a sure footing in payments." This is no longer in the realm of ideas as cash usage declines worldwide. Sweden’s Riksbank has the e-krona under serious consideration, while The Bank of Canada has released research on a potential Digital Dollar that it says could improve consumption, achieve welfare gains and allow for more flexibility in setting differing interest rates across business sectors.

In general, Carney repeated his scepticism of cryptocurrencies, saying it was “early days for cryptoassets” and that “in their current form they are not promising as a form of money let alone as a global currency. They are poor stores of value – for example there is extreme daily variation in their value.”

However, peer-to-peer technologies are changing the world, Carney acknowledged, saying: “Crypto-assets are an attempt to create the financial architecture for peer-to-peer transactions. People are increasingly forming connections directly, instantaneously and openly, and this is revolutionising how they consume, work, and communicate. Yet the financial system continues to be arranged around a series of hubs and spokes like banks and payments, clearing and settlement systems.”

The Governor also outlined a more hopeful message for those involved in crypto and fintech, saying that old institutions had be open to this new technology and the idea that cryptoassets are the financial architecture for this new world.

He writes: “Even if the current generation is not the answer, it is throwing down the gauntlet to the existing payment systems. These must now evolve to meet the demands of fully reliable, real-time, distributed transactions.”

Carney acknowledged the potentially transformative possibilities of a Central Bank Digital Currency (CBDC), based on the same blockchain tech that powers Bitcoin, Ethereum and other cryptocurrencies. “Crypto-assets raise the obvious question about whether their technology could be combined with the trust inherent in existing fiat currencies to create a CBDC. Currently only banks can hold central bank money electronically in the form of a settlement account at the Bank of England. The Bank has an open mind about the eventual development of a CBDC and has an active research and pilot programme dedicated to it. That said, given current technological shortcomings in distributed ledger a true, widely available reliable CBDC is still a long-term prospect.”

However, Carney said, the use of distributed ledger technology to innovate and improve payments was much more likely to come sooner. “Our current priority…[is] to support further innovation in payments by building the right public infrastructure, such as the RTGS renewal programme to support societies changing preferences, such as peer-to-peer transactions and cross-border payments."

Since spring last year the Bank has been refreshing its Real Time Gross Settlements payments infrastructure, and working alongside regulators and central banks in Singapore and Canada to involve blockchain.

The Bank had worked with Ripple in 2017 as “part of a proof of concept exercise where we explored whether two transactions in different currencies could be executed simultaneously in separate RTGS payment systems,” said Carney.

“We did the test by simulating the RTGS systems in the cloud. The proofs-of-concept are all available on the Bank’s website. In this case, the team was able to show that we could successfully synchronise transactions across RTGS systems. The important test is that, if one of the synchronised transactions fails to go through, the other part should not go through. That shows the system is working properly and could in principle be used for cross-currency conversions. This is one of many things that could solve the problem of slow and costly cross-border payments: at the moment, they are 10 times more expensive than domestic payments.”

While Ripple did not become a Bank of England partner after that initial pilot, it has since made solid headway with several exchanges in the Middle East and has partnered with the National Bank of Abu Dhabi for cross-border payments.

Carney explains: “We are in the midst of an ambitious rebuild of the RTGS system – the backbone of every payment in the UK. This rebuild will make it easier for people to plug in and pay, even across borders, by allowing access to a host of new, non-bank payment providers. The electronic money flowing through their systems will become more like its physical relative. More electronic payments will become instantaneous by using QR codes or mobile phone numbers. Checkout can be eliminated.”

So while there is still scepticism from the head of Britain’s central bank over cryptoassets, it is evident that its leaders will not shy away from the technological revolution that blockchain and distributed ledger tech will bring.

The Governor's full comments, including a wider range of topics, can be found here.

Insights

Market Insights

23.01.2024

Coppercasts

24.07.2024

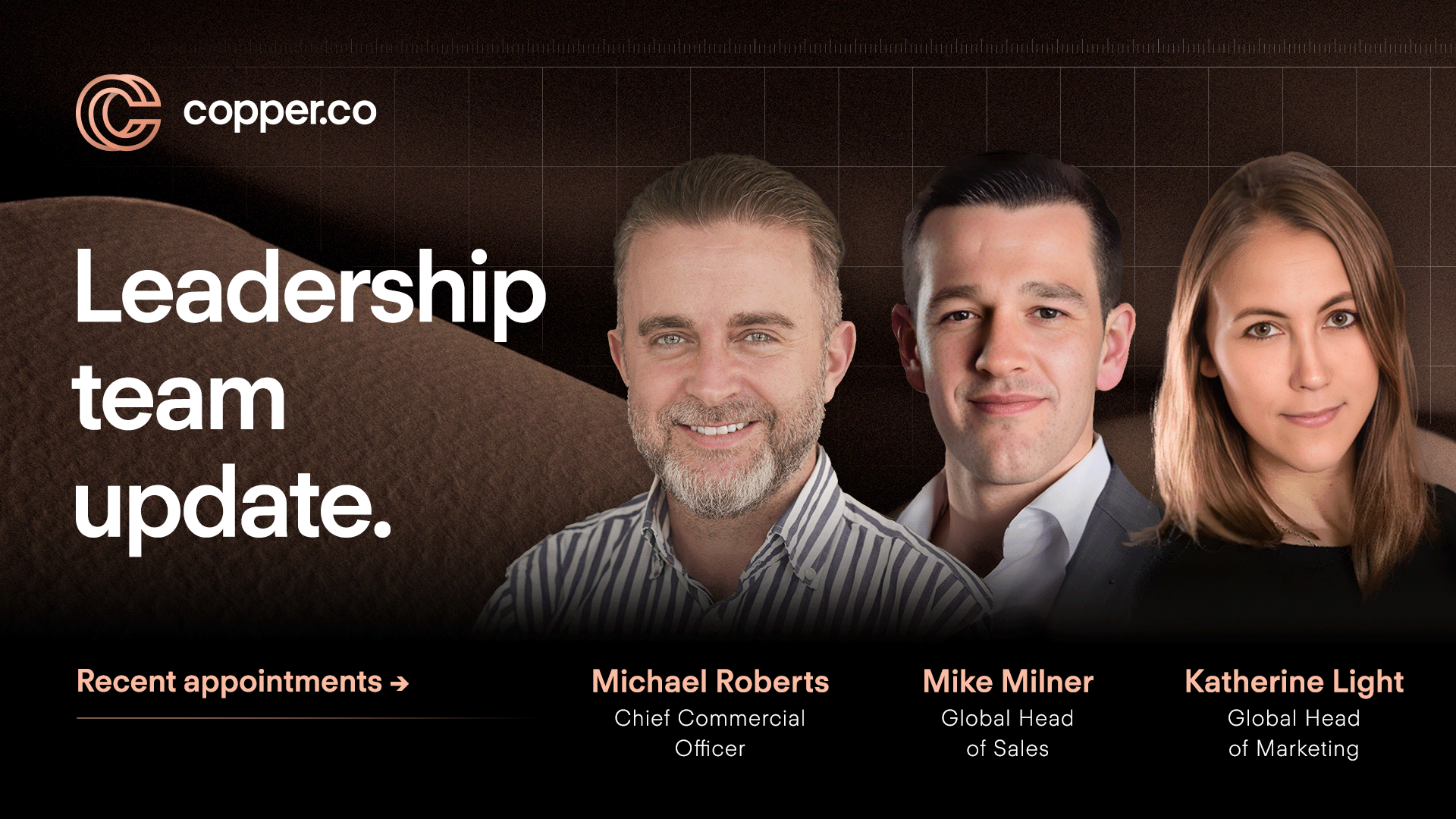

Company News

23.07.2024