The most frequent criticism levelled at cryptoassets is that the blockchains that underpin them are unable to scale.‘Sure,’ says the world, ‘it’s fine to create new systems of money and value transfer, but if they are so slow and expensive that no-one can use them, what’s the point?’

Because Bitcoin miners - who secure the network - are allowed to choose which transactions they include first (usually those with the highest fee per byte), congestion can be a severe problem.

At any time there can be many tens of thousands of Bitcoin transactions sitting in the mempool waiting to be confirmed.

Imagine a giant queue of people snaking out of a bank, all waiting to hand over money to the teller. Until the person in front has had their transaction confirmed, the next person cannot move up. The more popular it gets, the less efficient it becomes.

Layer 2 solutions attempt to solve these problems with a simple yet elegant proposition: thinking of any underlying blockchain as a base layer.

What if we built platforms that sat on top of this base layer, offloading transactions - or the computations required for smart contracts - away from the main chain? With less number-crunching required on the base layer, the entire blockchain would speed up, giving us better performance at a reduced cost.

The term ‘Layer 2’ harks back the TCP/IP tech stack that created the internet and all the various protocols that now sit on top of it.

‘Layer 1’ infrastructure allowed for the initial work of machines being networked together. The later protocols that created applications like email and distributed webpages that could be linked together using HTTP were called ‘Layer 2’. Because advocates believe we are just at the beginning of blockchain’s true development, this naming structure has been adopted by the community.

How badly do we need Layer 2? Quartz reported in December 2017 how the Ethereum blockchain was congested by the launch of the CryptoKitties app, a tamagotchi-like game where participants spend ether to breed digital cats. At its peak CryptoKitties accounted for 12% of all Ethereum transactions with the number of unprocessed transactions rising six-fold in a matter of weeks.

And the 2018 cryptoasset benchmarking study from the Cambridge Judge Centre for Alternative Finance (CCAF) notes that as interest in Bitcoin boomed, its blockchain “experienced significant delays in processing transactions, with average fees rising to levels above $50.”

The most promising Layer 2 solutions at present are Bitcoin’s Lightning Network and Ethereum’s Raiden.

Lightning Network (LN) is a payment protocol conceived by Thaddeus Dryja and Joseph Poon in their 2016 white paper.

It sits on top of Bitcoin’s base layer, moving processes away from the main chain in order to shorten the queue of unconfirmed transactions, keeping transactions instant, and crucially, with near-zero transaction fees.

Poon and Dryja argued: “If each node must know about every single transaction that occurs globally, that may create a significant drag on the ability of the network to encompass all global financial transactions.”

Instead LN allows payments to be securely routed between multiple p2p payment channels, which enables transactions between two parties who are not directly connected.

It is already in use and growing steadily. An explorer by French startup ACINQ shows there are now more than 4,000 active nodes supporting over 31,000 channels across the globe, with the majority clustered in central Europe and on the east coast of North America.

Plasma was considered the saviour of a congested Ethereum when it appeared in August 2017. Vitalik Buterin and LN creator Joseph Poon put forward the simple idea of taking processing load away from the main chain to distribute work onto a tree-like structure of many smaller ‘child’ chains that branched off from the main Ethereum blockchain.

An unlimited number of alternate chains could be created in this structure with each Plasma chain working as a bespoke smart contract, operating independently. However, development stalled and the last Github commit was in June 2018.

More promising is the Python-based Raiden off-chain scaling solution, which received an alpha test launch on the Ethereum mainnet in December 2018 and has had over 8,000 Github commits.

If you want to transfer ether or ERC20 tokens on the Ethereum blockchain, the transaction will cost you fees depending on the computational power required. Just as with Bitcoin, you have to wait for confirmation depending on block times and how long it takes for miners to pick your transaction from a pending mempool.

Raiden, by contrast, promises near-instant transactions with very low fees. The protocol can transfer ERC20 tokens without involving the base layer by using a digitally signed hash-locked “balance proof” that opens a binding smart contract payment channel between two participants. The underlying blockchain is not involved except when the channel is opened and closed.

You still need the base blockchain to open and close channels, so making individual payment channels between all possible payers and payees is infeasible. Happily though, devs say, “as it turns out, you do not need a direct payment channel between a payer and payee if there exists at least one route through a network of channels that connects the two parties. The capacity of the Raiden network scales linearly…[and] Raiden transfers are instant, in the sense that as soon as you receive an off-chain Raiden transfer, you can rest assured that the transferred value now belongs to you.”

Scaling linearly with the number of users would be a huge leap forward. No more lines that get longer as a blockchain gets more popular.

Andrey Pshenkin, a backend developer with Copper, added, "In my opinion, current Layer 2 protocols are trying to solve current dApps scaling problems. And they can do this in B2B and B2C world. But they can't solve the main blockchain scalability issue - speeding up everyday transfers. You still need to make transactions (at starting and closing channels), and a normal C2C person will not use channels.

"There are three real issues here:

"IMHO, there should be a Layer 1 protocol that allows you to scale genesis blockchains (e.g. unlimited amount of chains, but with availability to receive access/validate something in any chain). But I don’t think we will see something like that in the blockchains that are already active (e.g. Bitcoin or Ethereum). Maybe Telegram’s TON network could solve this? It remains to be seen, if and when the blockchain launches in Oct 2019.

"Also, the big problem of scalability is the huge volume of data that has to be stored/mined. Adding any Layer N protocols will not solve this. There will need to be a complex solution of how to "archive" old blockchain data."

Researchers for the CCAF’s 2018 study mentioned above spent several months surveying 180 cryptoasset service providers in 47 countries. The results speak for themselves.

More than stablecoins, security tokens or Central Bank Digital Currencies (which several central banks are studying as we speak), industry players believe that Layer 2 solutions will have the greatest impact on the space.

If we can zoom out and try to see Bitcoin, Ethereum et al as base layers, rather than finished products, it makes sense that that the future will bring much greater development. The internet’s second layer gave us email and linked webpages and we are only 10 years into the cryptoasset experiment. Who knows what Layer 3 and 4 may bring?

Insights

Market Insights

23.01.2024

Coppercasts

12.07.2024

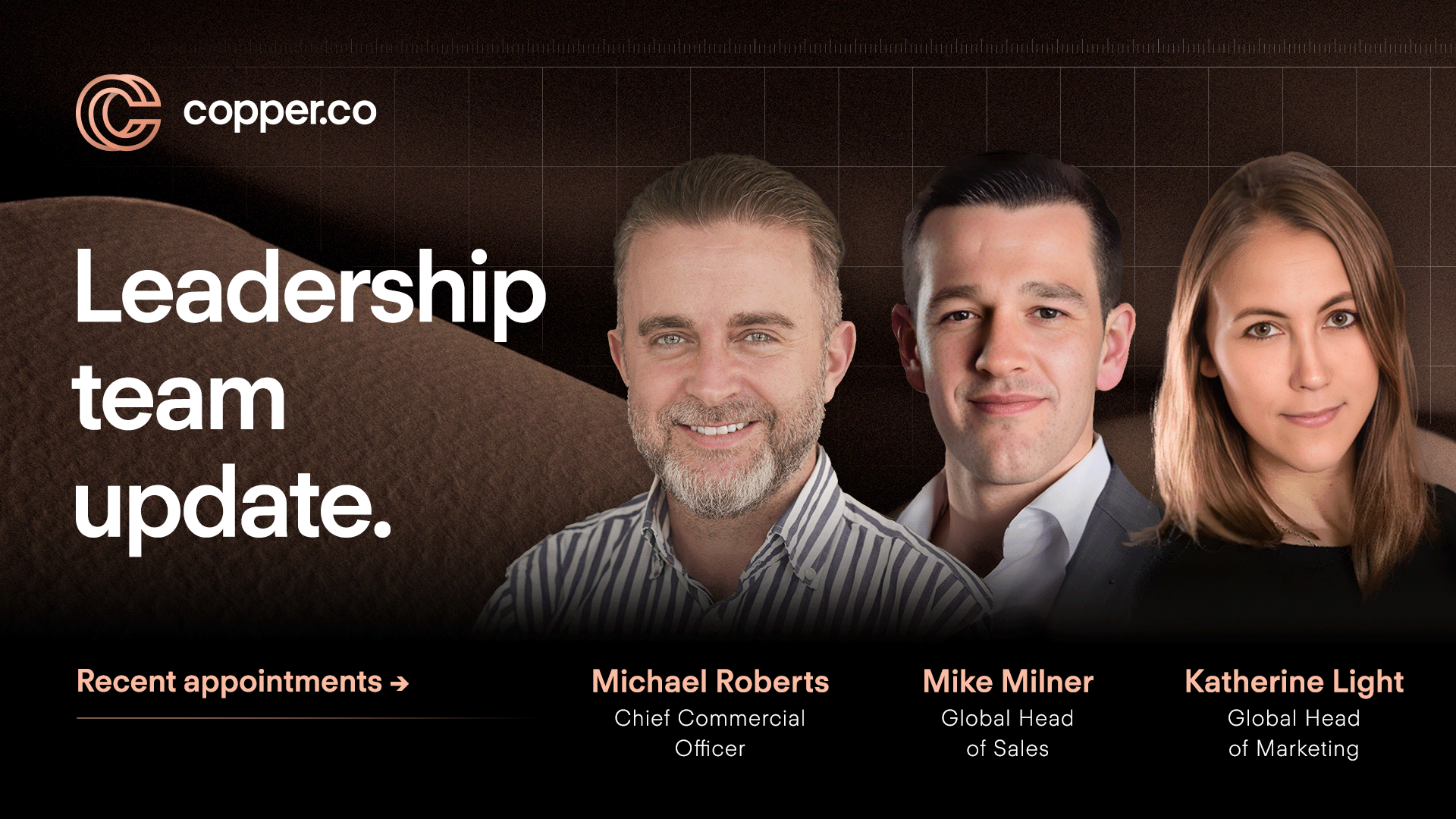

Company News

23.07.2024